What you should know about

TRANSFER TAXES

Illinois is a great place to live. But local elected ofcials have found a way to make

it more expensive to stay in the state’s communities by levying transfer taxes on

real estate sales.

WHAT’S A REAL ESTATE TRANSFER TAX? Home Rule municipalities may impose a tax on

buyers and sellers of real estate. These taxes are imposed at closing and can add signicantly to

the cost of selling private property.

How a transfer tax works

What’s the cost

Who pays?

Most of the time, sellers pay. In some communities, buyers are hit

with the tax. In Chicago, both buyers and sellers must pay a transfer tax.

In addition to the municipal transfer tax, each county in Illinois

assesses a transfer tax at the rate of 50 cents per thousand dollars of the

sale price.

TRANSFER TAXES

ARE ASSESSED WHEN

A PROPERTY IS

TRANSFERRED/SOLD.

Most municipalities in Illinois with

transfer taxes charge a set amount

per $1,000 of the sales price.

For example, in Aurora,

sellers must pay $3

for every $1,ooo in a

transaction

.

That means a

$2oo,ooo home sale comes

with an additional $6oo fee

tacked on at closing!

Some communities charge a per

transaction fee that is the same no

matter the amount of the real estate

deal, but this is less common.

Assuming you are in a community

which has a transfer tax, you can

pay as little as $50 per transaction,

or as much as $10 per $1,000 of a

real estate transaction.

Since 1997, communities in

Illinois must ask voters through

a referendum for permission to

impose a transfer tax. Even if a

community already has a transfer

tax, it still must ask voters for

approval to adjust the tax rate.

An important note: Only

a Home Rule community can

impose a transfer tax. In Illinois,

that typically means a municipality

has more than 25,000 residents

or voters in the community have

agreed to yield direct say over tax

and fee increases to their elected

ofcials.

How does a community impose a transfer tax?

1

IT ADDS TO THE TAX BURDEN ON PROPERTY

OWNERS: Many communities in Illinois already have

high property taxes. After years of paying these taxes,

owners are then obligated to pay one more tax when

they sell their properties. These taxes add up, making

it much more expensive to live in the state.

2

EQUITY KILLER: Transfer taxes are essentially an “exit

tax” which chips away at the equity private property

owners have built up over the years.

3

ONE OF MANY TAXES: Transfer taxes in and of

themselves are costly. But, if they are added to

a buyer’s closing costs they may come on top of

expensive pre-sale inspection fees and requirements.

For rst-time buyers and those seeking affordable

housing, transfer taxes can make realizing the dream

of homeownership much harder.

4

TAX IMPLICATIONS: Transfer taxes cannot be

deducted on your state and federal income taxes.

The dangers of transfer taxes

MORE THAN 70 ILLINOIS

COMMUNITIES HAVE TRANSFER

TAXES OF VARYING AMOUNTS

Real Property Alliance has an updated list of

communities and the tax rates.

Find it at:

www.IllinoisRealtors.org/legal/legal-a-z/transfer-tax

Want to learn more?

Illinois REALTORS

®

is the only advocate

for private property rights at the Capitol in

Springeld and in communities statewide.

www.IllinoisRealtors.org

522 S. 5th Street | Springeld, IL 62701

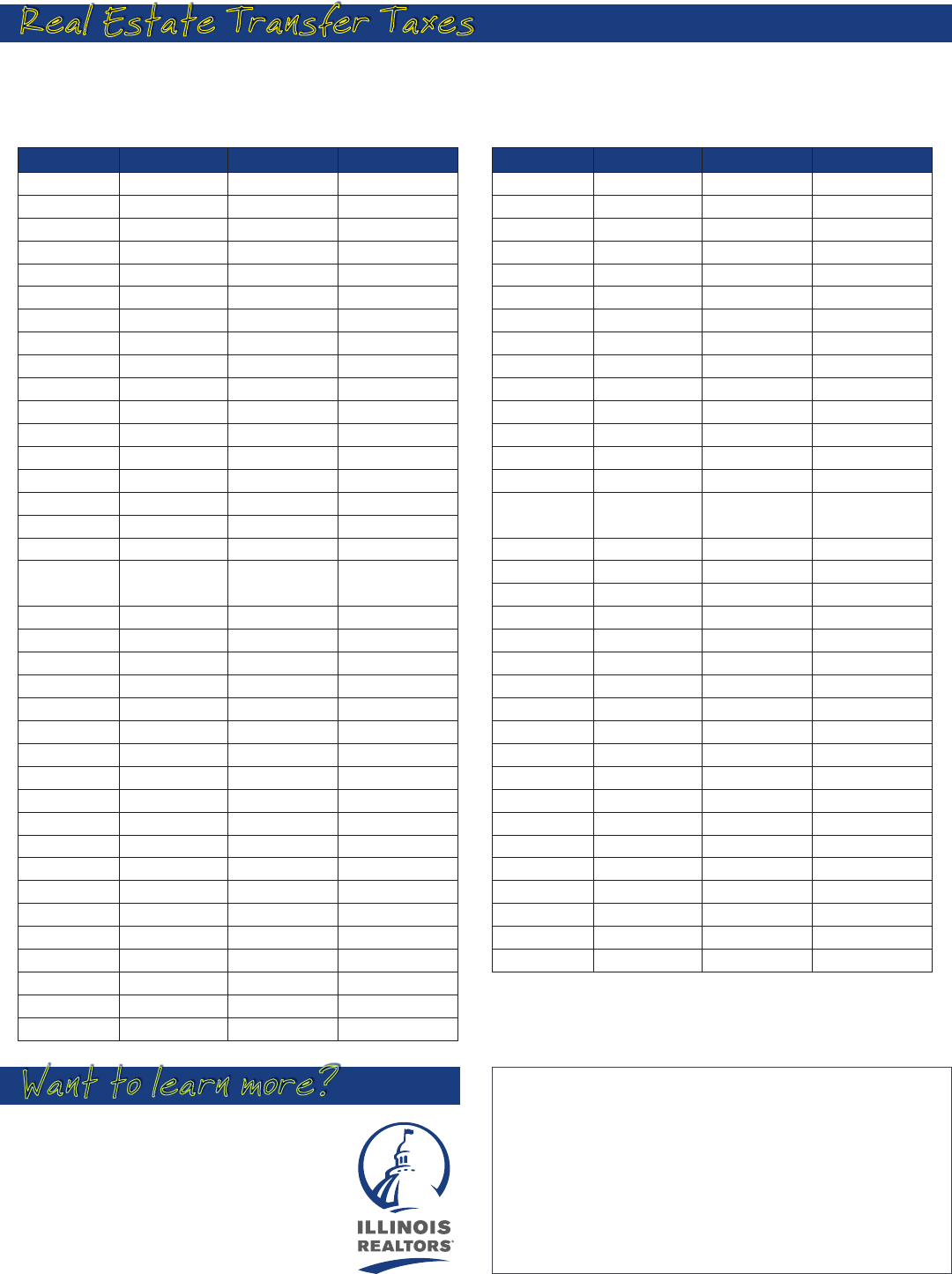

Real Estate Transfer Taxes

State of Illinois $.50/$500 County Building Either; Seller customary

All Illinois Counties $.25/$500 County Building Either; Seller customary

Addison $2.50/$1,000 Village Hall Buyer

Alsip $3.50/$1,000 Village Hall Seller

Aurora $3/$1,000 City Hall Seller

Bartlett $3/$1,000 Village Hall Seller

Bedford Park $50 at fee City Hall Seller

Bellwood $5/$1,000 Village Hall Seller

Berwyn $10/$1,000 Village Hall Seller

Bolingbrook $7.50/$1,000 Village Hall Split

Buffalo Grove $3/$1,000 Village Hall Seller

Burbank $5/$1,000 City Hall Seller

Burnham $5/$1,000 Village Hall Buyer

Calumet City $8/$1,000 Village Hall Split

Calumet Park $5/$1,000 Village Hall Buyer

Carol Stream $3/$1,000 Village Hall Seller

Channahon $3/$1,000 Village Hall Buyer

Chicago

$7.50/$1,000 Buyer

$3.00/$1,000 Seller

City Hall

$7.50/$1,000 Buyer

$3.00/$1,000 Seller

Chicago Heights $4/$1,000 City Hall Seller

Cicero $10/$1,000 Town Hall Seller

Country Club Hills $5/$1,000 City Hall Seller

Countryside $50 at fee City Hall Either

Des Plaines $2/$1,000 City Hall Seller

Dolton $10 per property Village Hall Seller

East Hazel Crest $25 at fee City Hall Buyer

Elk Grove Village $3/$1,000 Village Hall Seller

Elmhurst $1.50/$1,000 City Hall Seller

Elmwood Park $5/$1,000 Village Hall Seller

Evanston $5/$1,000 City Clerk Seller

Evergreen Park $5/$1,000 Village Hall Seller

Freeport $4/$1,000 City Hall Seller

Glendale Heights $3/$1,000 Village Hall Seller

Glen Ellyn $3/$1,000 Village Hall Seller

Glenwood $5/$1,000 Village Hall Seller

Hanover Park $3/$1,000 Village Hall Seller

Harvey $4/$1,000 City Clerk Buyer/Seller split

Harwood Heights $10/$1,000 Village Hall Buyer

Highland Park $5/$1,000 Village Hall Seller

Hillside $7.50/$1,000 Village Hall Buyer

Hoffman Estates $3/$1,000 Village Hall Seller

Joliet $3/$1,000 City Hall Seller

Lake Forest $4/$1,000 Buyer *

Lincolnshire $3/$1,000 Village Hall Buyer

Maywood $4/$1,000 Village Hall Seller

McCook $5/$1,000 Village Hall Seller

Mettawa $5/$1,000 Buyer

Morton Grove $3/$1,000 Village Hall Seller

Mount Prospect $3/$1,000 Village Hall Buyer

Naperville $3/$1,000 Village Hall Buyer

Niles $3/$1,000 Village Hall Buyer

North Chicago $5/$1,000 City Clerk Buyer

Oak Lawn $5/$1,000

Village or Downtown

Ofce

Seller

Oak Park $8/$1,000 Village Hall Seller

Park Forest $5/$1,000 Village Hall Seller

Park Ridge $2/$1,000 City Hall Seller

Peoria $2.50/$1,000 Village Clerk Seller

River Forest $.50/$1,000 Village Clerk Seller

Robbins $25 per property Village Hall Seller

Rolling Meadows $3/$1,000 Village Hall Seller

Romeoville $3.50/$1,000 Village Hall Buyer

Schaumburg $1/$1,000 Village Hall Seller

Skokie $3/$1,000 Village Hall Seller

Stickney $5/$1,000 Village Hall Seller

Stone Park $4/$1,000 Village Hall Seller

Streamwood $3/$1,000 Village Hall Seller

Sycamore $5/$1,000 Village Hall Buyer **

University Park $1/$1,000 Village Hall Seller

Westchester $25 at fee City Hall Seller

Wheaton $2.50/$1,000 Village Hall Buyer

Wilmette $3/$1,000 Village Hall Buyer

Woodridge $2.50/$1,000 Village Hall Seller

Taxing Body Amount of Tax Place for Purchase

Party Liable

Taxing Body Amount of Tax Place for Purchase

Party Liable

Listing of all Municipal Real Estate Transfer Taxes in Illinois

Also shown is the party liable for payment of the tax.

The information in this chart is current as of January, 2018.

* A rebate of the transfer tax owed in an amount up to $2,000 will be given to Lake Forest

residents who move between residences within Lake Forest

** Exemption for current Sycamore residents

Want to learn more?

Illinois REALTORS

®

is the only advocate

for private property rights at the Capitol in

Springeld and in communities statewide.

www.IllinoisRealtors.org

522 S. 5th Street | Springeld, IL 62701