Maria Pappas

Cook County Treasurer

🖥

Publication of the Cook County Treasurer’s Research Department

All Rights Reserved

studies and helpful information

for property owners

www.cookcounty treasurer.com

Oce of Cook County Treasurer Maria Pappas

April 2024 Update

(Original: August 2023 )

How the Illinois

Property Tax

System Works

IF PAYING LATE,

PLEASE PAY

07/02/2023 - 08/01/2023

$0.00

08/02/2023 - 09/01/2023

$0.00

09/02/2023 - 10/01/2023

$0.00

LATE INTEREST IS 1.5% PER

MONTH, BY STATE LAW

TAXING DISTRICT BREAKDOWN

Taxing Districts

2021 Tax

2021 Rate

2021 %

Pension

2020 Tax

MISCELLANEOUS TAXES

Des Plaines Valley Mosq Abate Dist Lyons

6.17

0.014

0.10%

5.68

Metro Water Reclamation Dist of Chicago

168.42

0.382

2.73%

18.51

178.90

Summit Public Library District

193.55

0.439

3.14%

4.40

252.74

Summit Park District

241.17

0.547

3.91%

18.51

231.91

Miscellaneous Taxes Total

609.31

1.382

9.88%

669.23

SCHOOL TAXES

Moraine Valley College 524 Palos Hills

173.71

0.394

2.82%

166.12

Argo Community HS District 217 (Summit)

1,625.56

3.687

26.37%

51.14

1,526.83

Summit School District 104

2,436.36

5.526

39.52%

132.70

2,616.35

School Taxes Total

4,235.63

9.607

68.71%

4,309.30

MUNICIPALITY/TOWNSHIP TAXES

Village of Summit

1,012.72

2.297

16.43%

345.65

1,016.15

Lyons Mental Health

38.36

0.087

0.62%

37.86

Road & Bridge Lyons

17.19

0.039

0.28%

17.04

General Assistance Lyons

2.20

0.005

0.04%

1.42

Town of Lyons

18.96

0.043

0.31%

18.93

Municipality/Township Taxes Total

1,089.43

2.471

17.68%

1,091.40

COOK COUNTY TAXES

Cook County Forest Preserve District

25.57

0.058

0.41%

0.88

27.45

Consolidated Elections

8.38

0.019

0.14%

0.00

County of Cook

107.14

0.243

1.73%

38.79

128.76

Cook County Public Safety

57.76

0.131

0.94%

62.47

Cook County Health Facilities

31.74

0.072

0.51%

23.19

Cook County Taxes Total

230.59

0.523

3.73%

241.87

TAX CALCULATOR

IMPORTANT MESSAGES

2020 Assessed Value

14,683

2021 Property Value

146,830

2021 Assessment Level

X 10%

2021 Assessed Value

14,683

2021 State Equalizer

X 3.0027

2021 Equalized Assessed Value (EAV)

44,089

2021 Local Tax Rate

X 13.983%

2021 Total Tax Before Exemptions

6,164.96

2021 Total Tax Before Exemptions

6,164.96

Homeowner's Exemption

.00

Senior Citizen Exemption

.00

Senior Freeze Exemption

.00

2021 Total Tax After Exemptions

6,164.96

First Installment

3,471.49

Second Installment +

2,693.47

Total 2021 Tax (Payable in 2022)

6,164.96

PROPERTY LOCATION

5519 S 72ND CT

SUMMIT IL 60501 2205

(Do not pay these totals)

6,164.96

13.983

100.00%

6,311.80

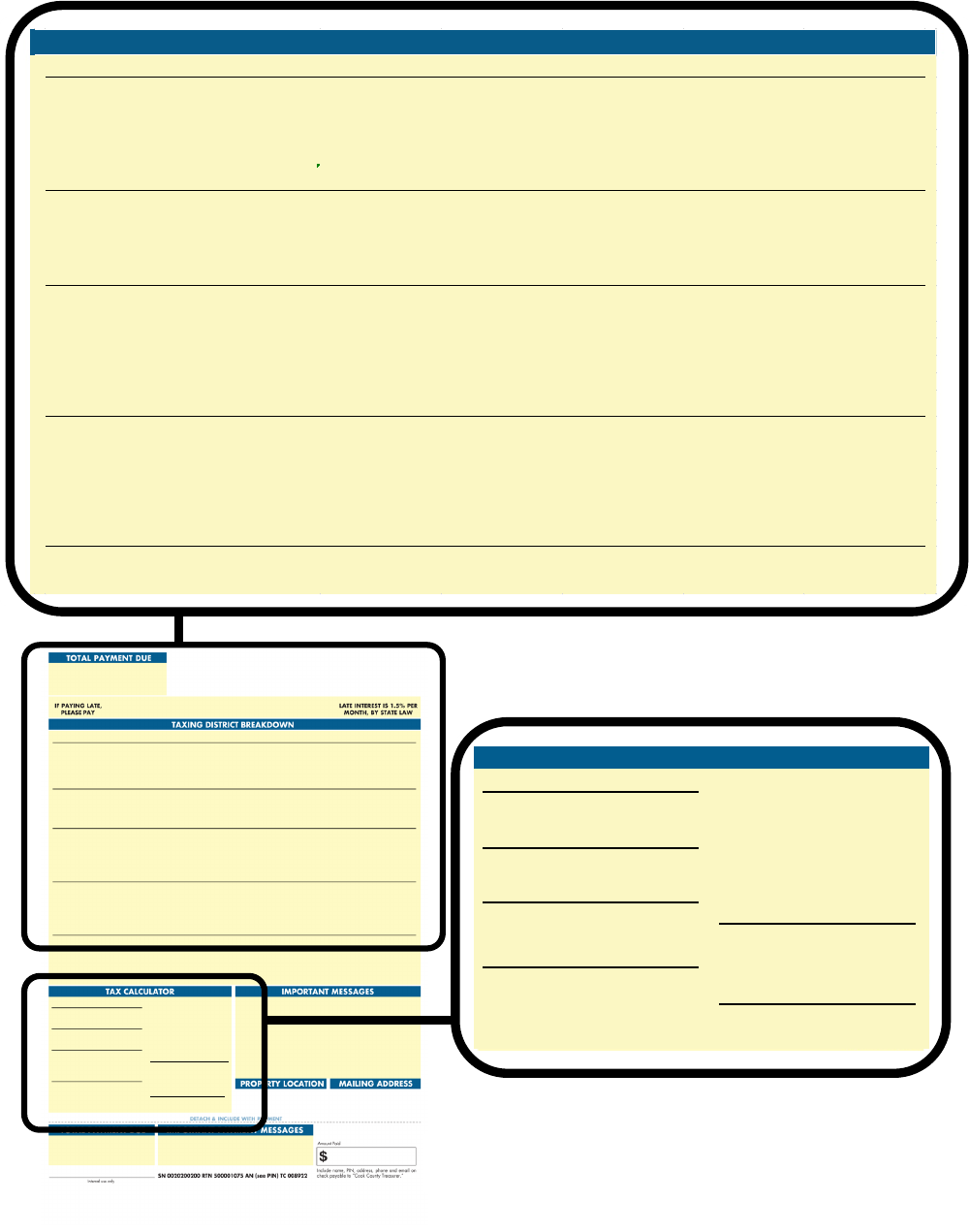

2021 Second Installment Property Tax Bill - Cook County Electronic Bill

Property Index Number (PIN)

Volume

Code

Tax Year

(Payable In)

Township

Classification

18-13-206-015-0000

080

21038

2022

(2023)

LYONS

2-03

$0.00

By 07/01/2023

*** Please see 2021 Second Installment Payment Coupon next page ***

MAILING ADDRESS

FRANCISCO J URBINA

5155 S MELVINA AVE

CHICAGO IL 606381430

TOTAL PAYMENT DUE

The Treasurer’s

Oce sends more

than 3.2 Million

Tax Bills every

single year.

Property taxes have served as a way to fund government

in the United States since the founding of the country

— at a time when property ownership typically was syn-

onymous with wealth, making it a mostly progressive tax

in the 18th and 19th centuries.

Introduction

The federal government and

the vast majority of state

governments have stopped

using that tax to fund

government, in part because

property ownership and wealth

are no longer so closely linked,

making it a regressive tax in

many instances.

Nevertheless, property taxes

continue to be a major source of

revenue for local governments.

In 40 U.S. states, the biggest

single source of income for local

governments is the property tax,

according to the Pew Research

Center

1

.

It remains the case despite a

growing body of studies that

question whether the overall

property tax burden can be

spread equitably, whether the

revenue it generates can be dis-

tributed fairly and whether the

1 (The Pew Charitable Trusts, 2021)

https://www.pewtrusts.org/en/research-

and-analysis/data-visualizations/2021/

how-local-governments-raise-their-tax-

dollars

enforcement of tax payments

through sales of delinquent

taxes disproportionately affects

people of color.

In Illinois, those questions

have dominated the debate

over property taxes in recent

decades, leading to limits

on property tax increases, a

revamping of the Cook County

property tax assessment

system, reforms to the state

property tax code and changes

to the way the state distributes

public-school funding to make

educational opportunities more

equitable between wealthier and

poorer communities.

Photo Credits

Andrew Jameson, left

Rachel Bires, right

Contents

Introduction ...........................1

Pension liabilities .......................5

So Many Government Agencies.. .............6

The Cook County Property Tax Process ........9

Appendix .............................27

Offices Involved in Property Taxation ........29

Additional Sources ......................30

References ...........................31

Glossary .............................33

2

How the Illinois Property Tax System Works

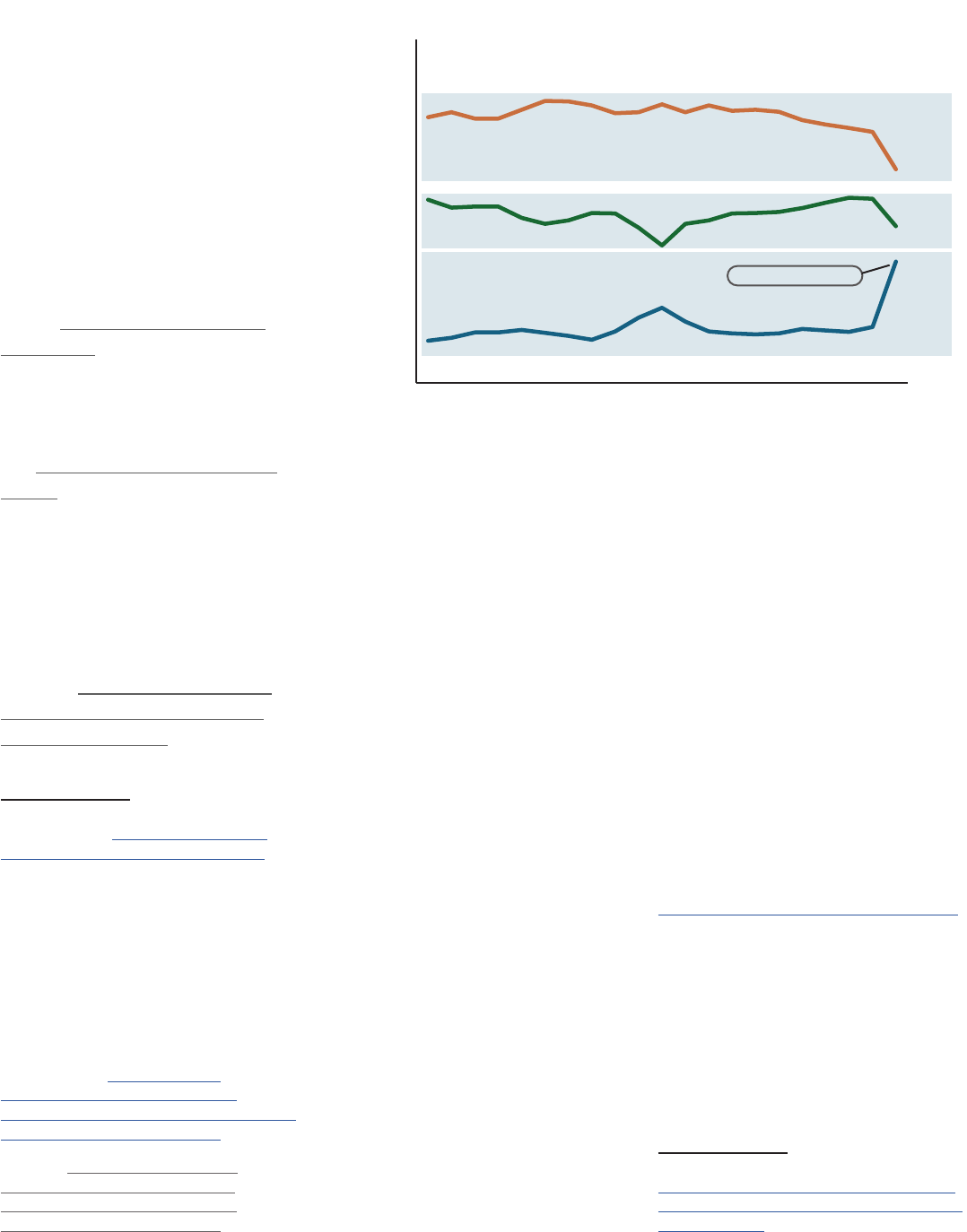

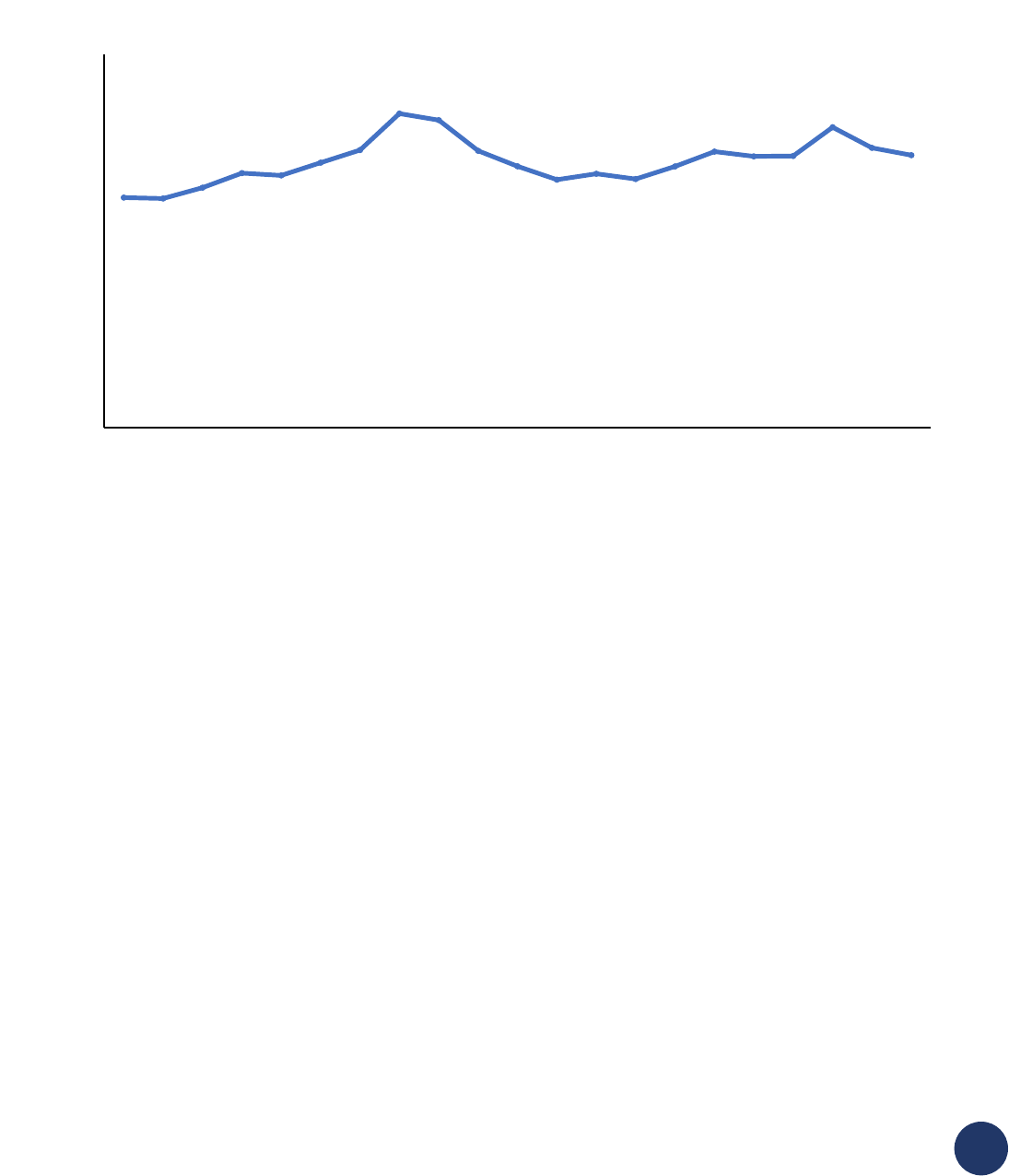

Illinois nevertheless continues to

rely heavily on property taxes to

fund local government, particu-

larly for kindergarten through

12th grade public education.

Historically, more than half of

public-school funding in the

state has come from property

tax-derived revenue, according

to the Illinois State Board of

Education

2,3

(Figure 1).

In Illinois, 39% of all local gov-

ernment revenue comes from

property taxes, according to

the Lincoln Institute for Land

Policy

4

. That compares with

an average of 30% across the

nation.

Although many other states rely

more heavily, in percentage of

revenue, on property taxes to

fund local government, Illinois

still has the nation’s second-

highest effective residential

property tax rates

5

— dened as

the percentage of a property’s

2 (Illinois State Board of Education, 2021

Annual Report) https://www.isbe.net/

Documents/2021-Annual-Report.pdf

3 In the 2020-2021 school year, when

school coffers, the percentage of public

education derived from property taxes

dropped to 43.5%, but that number will rise

again in coming years once all pandemic

funds are spent.

4 (Lincoln Institute of Land Policy,

“State-by-State Property Tax at a

Glance,” 2023) https://www.lin-

colninst.edu/research-data/data-

state-state-property-tax-glance

5 (ibid) https://www.lincolninst.

edu/research-data/data-toolkits/

state-state-property-tax-glance

value that is paid in taxes each

year, according to multiple

studies. Only New Jersey has

a higher effective property tax

rate. (See Figure 2)

Looked at another way, the

median residential property tax

bill in Illinois between 2015 and

2019 was $4,529, compared to

an average of $2,551 across the

nation, according to the Lincoln

Institute. That median Illinois

tax bill is the sixth highest in the

country.

There are many reasons that

property taxes are higher in

Illinois than other states that

rely more heavily, in percent-

age terms, on that tax for local

revenue. Among them: the

heavy reliance on the tax for

school funding, outsized costs

associated with restoring nan-

cial health to the state’s under-

funded government worker and

teacher pension systems, and

the high number of local govern-

ments in the state.

Illinois state govern ment pays

about 24% of all kindergarten

through 12th grade public

education costs, after pay-

ments for teacher pensions are

factored out, according to the

Illinois State Board of Education.

That’s the lowest funding level

among all 50 states, according

to the Center for Budget and Tax

Accountability.

6

6 (Illinois Report Card, 2022-2023 ), 2022)

https://www.illinoisreportcard.com/State.

aspx?source=environment&source2=reven

uepercentages

Federal Taxes

24.7%

State Taxes

31.9%

Local Property Taxes

43.5%

0%

10%

20%

30%

40%

50%

60%

70%

2000-

2001

2002-

2003

2004-

2005

2006-

2007

2008-

2009

2010-

2011

2012-

2013

2014-

2015

2016-

2017

2018-

2019

2020-

2021

% of Total Education Funding

2000-2021

See Footnote 3

Figure 1. Share of education funding by jurisdiction (Source: Illinois State Board of Education

2.1%

2.1%

2.5

1.9%

Illinois 2.2%

New Jersey 2.5%

$2,551

Median Residential

Property

Tax Bill in the U.S.

$4,529

Median Residential

Property Tax Bill in

Illinois

Figure 2. The top ve states in the US in terms of effective property tax (Source: Lincoln Institute of Land

Policy)

4

How the Illinois Property Tax System Works

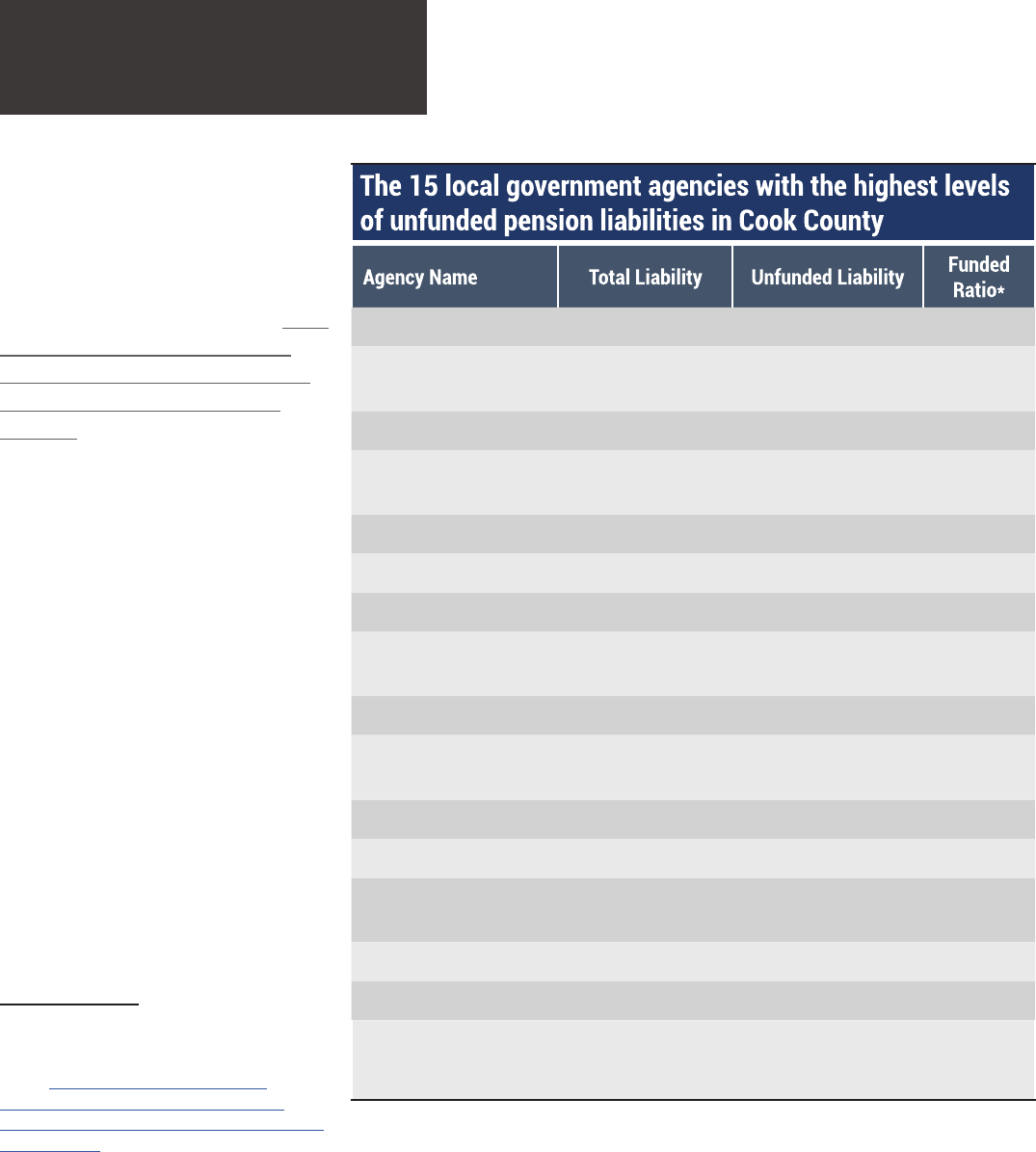

The 15 local government agencies with the highest levels

of unfunded pension liabilities in Cook County

Agency Name Total Liability Unfunded Liability

Funded

Ratio*

City of Chicago $73,965,305,000 $35,436,606,937 21.03%

Chicago Public

Schools

$30,130,285,000 $16,011,799,929 38.93%

County of Cook $19,531,125,441 $10,837,262,891 52.71%

Metro Water

Reclamation Dist.

$4,170,650,000 $1,020,180,000 66.04%

Chicago Park District $2,931,436,000 $1,691,529,000 16.91%

Village of Rosemont $785,915,187 $28,771,294 54.15%

Town of Cicero $593,244,407 $203,692,117 29.57%

Village of

Schaumburg

$581,210,504 $219,229,038 63.47%

City of Evanston $569,373,515 $185,786,857 73.59%

Cook County Forest

Preserve District

$548,552,253 $334,111,011 38.07%

City of Elgin $523,328,022 $194,043,835 73.92%

Village of Oak Lawn $505,889,070 $203,318,980 50.21%

School District U-46

(Elgin)

$431,703,576 $50,818,670 82.36%

City of Berwyn $410,163,141 $41,772,166 83.36%

Village of Oak Park $375,012,286 $139,192,803 67.35%

*Unfunded liabilities in this chart are calculated on an accrual basis. Individual

pension funds often calculate these numbers on an actuarial basis.

In addition, many municipalities

across Illinois have some of

the highest unfunded pension

liabilities in the U.S., which can

result in steep tax increases as

municipalities and counties take

steps to comply with a state

law that mandates those local

pension funds achieve 90%

funding

7

in the coming decades

(Figure 3).

decision:’ Niles Village Board approves

88% increase in property-tax levy,

2021) https://www.chicagotribune.

com/suburbs/niles/ct-nhs-tax-levy-tl-

1223-20211216-rv5odlvwp5aqrcdlaudbllx-

tvi-story.html

Pension Liabilities

Figure 3. Top Sources of Pension and Post-Employment Liabilities in Cook County, IL, (Source: The Pappas

Studies, Debt Report)

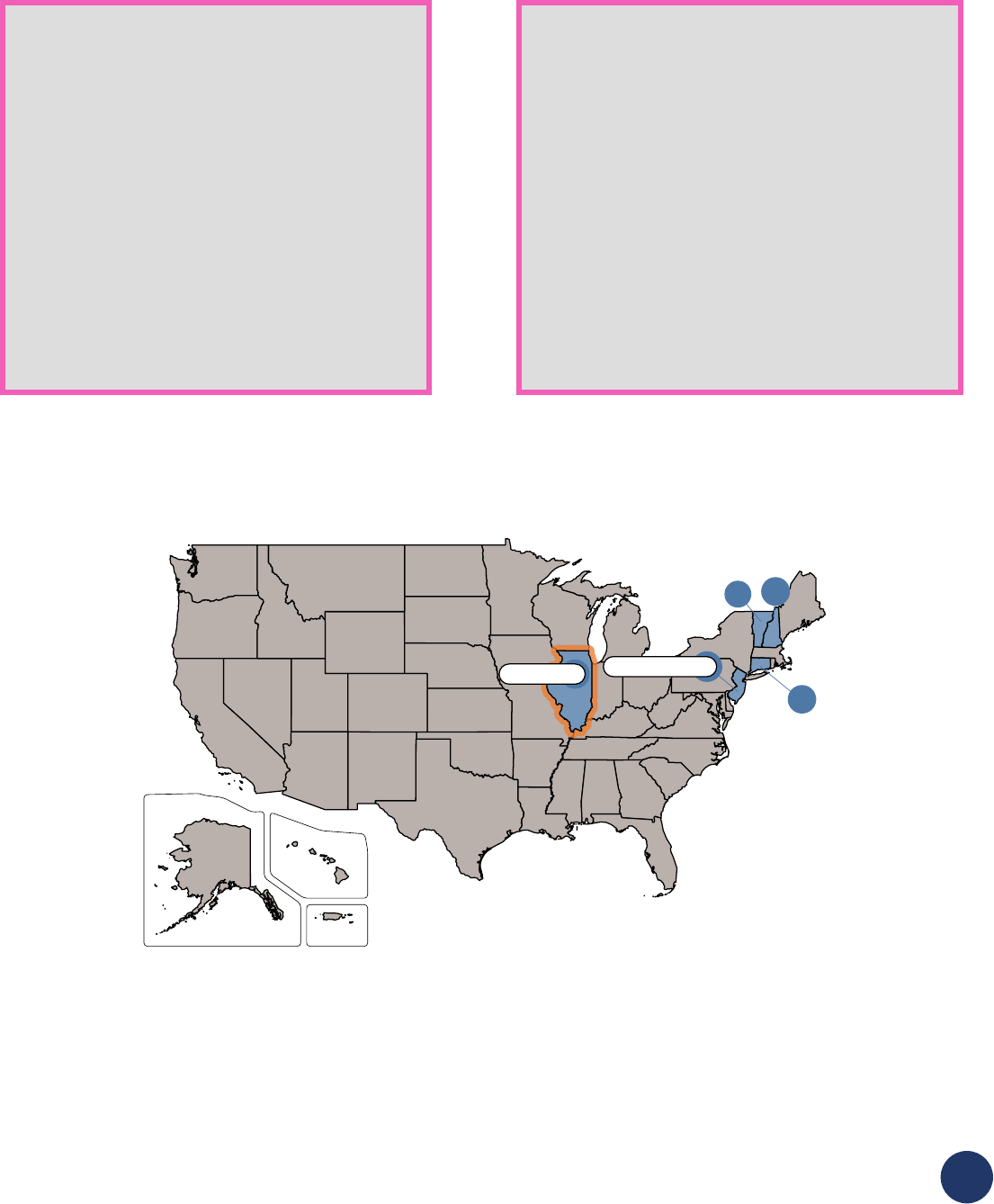

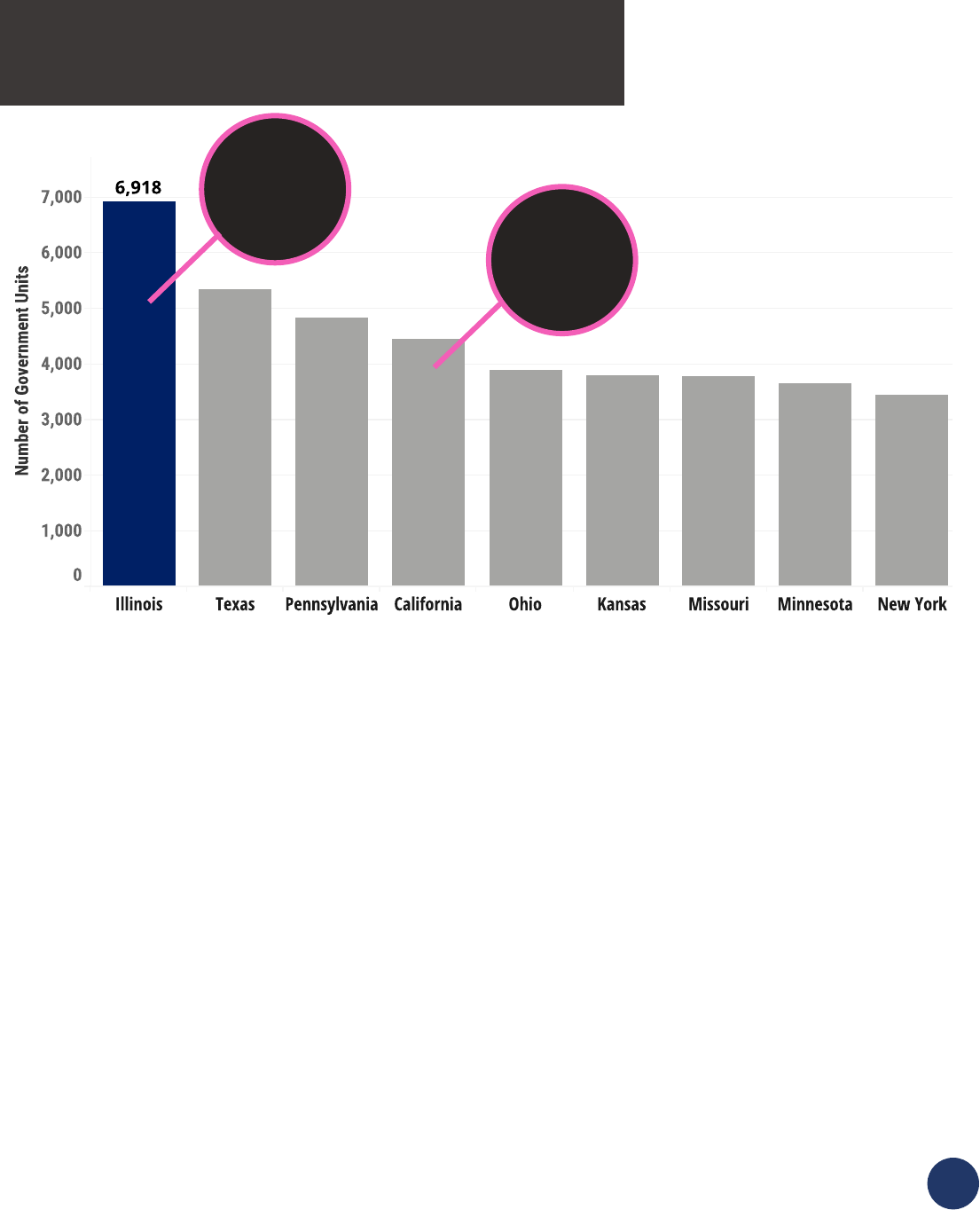

Another factor driving up the overall cost of

local government in Illinois is the extraordinarily

high number of local governments in the state.

Surveys from both the U.S. Census Bureau

and the Civic Federation government budget

watchdog group found that Illinois has the most

local governments of any state in the union. Each

government has its own bureaucracy that adds

costs borne by taxpayers (Figure 4).

Local governments across the nation tend to rely

heavily on property taxes because the amount

collected is generally stable. When the economy

falters, the other two major local government

sources of revenue — sales taxes and local

income taxes (Illinois does not have the latter) —

tend to decline.

Property taxes in many states don’t decline with

a downward turn in the economy, because of the

way they are determined. In those states, local

government property tax levies — the amount

governments seek to collect in a given year — are

established after budgets are drawn up, without

regard to ups and downs in the values of the

properties on which the taxes are paid. Sales

and income taxes, in contrast, are xed at certain

percentages, so the receipts from those two taxes

fluctuate based on consumers’ nancial health.

Figure 4. Top states by number of

sub-units of governments (Source:

U.S. Census)

So Many Government Agencies..

1 FOR

EVERY

1,800

PEOPLE

1 FOR

EVERY

8,800

PEOPLE

6

How the Illinois Property Tax System Works

No two states’ property tax systems are the

same, and in several, there are variations from

one locale to another. But generally, there are two

ways property taxes are set in the U.S.

2

)

In other states, including Texas, properties are rst assessed and then the rate is set, deter-

mining the amount of taxes to be collected. That method also allows local governments to

increase their rates when the total value of all property declines — unless the state enacts

strict rate limits.

*

Assessments Decrease

$100,000,000 to

$87,500,000

Tax Rate Increases

1% to 1.143%

Total Tax Amount

$1 million

* Many states, including Arizona and California, in recent decades have placed stricter limits on

tax rates through statutory and constitutional amendments, according to the Lincoln Institute

8

.

In those states, property tax bills can decrease when property values decline, but so do the

revenues at a time when governments are asked to do more.

Assessment Decreases

$100,000,000 to

$87,500,000

Tax Rate is Limited

1%

Total Tax Amount

$875,000

8 (Lincoln Institute of Land Policy, 2022)

state-state-property-tax-glance

1

)

In many states, like Illinois, New York and New Jersey, the levy — the overall amount of property

taxes sought by local taxing agencies — is set rst, followed by the tax rate. If the total value

of local properties declines, the tax rate is set higher to ensure the full levy is collected from

property owners.

Assessments Decrease

$100,000,000 to

$87,500,000

Total Tax Amount Set

$1 million

Tax Rate Increases

1% to 1.143%

One notable characteristic of property taxes —

not just in the U.S., but throughout the world — is

that all systems are dizzyingly complex, making it

tough for ordinary taxpayers to understand how

they work. For example, the Illinois property tax

code is laid out in more than 200,000 words that

prints out at more than 400 standard-size pages.

Each U.S. state devises its own tax system, often

with variations by region, and other countries

have similarly complex and diverse systems of

property taxation.

A Lincoln Institute working paper examining

European tax systems in 41 countries at the

start of this century found 190 different forms of

taxation. But European and other foreign govern-

ments tend to rely less on property taxes than

they do in the U.S., largely because schools tend

to be funded directly by national governments.

The notable exception is the United Kingdom,

which relies more on property taxation than the

U.S., according to the Tax Foundation.

It’s also worth noting that many states, but not

Illinois, tax “personal property” like cars, boats

and business equipment. The 1970 Illinois

constitution banned personal property taxes. To

make up for the lost revenue, the state assesses

a Personal Property Replacement Tax that ranges

from 0.8% to 2.5% of income on businesses and

utilities.

Of course, the process of determining tax levies,

and each property owner’s share of the tab, is

much more complex than just setting a levy and

then a rate. Assessments, appeals of assess-

ments, tax exemptions, the complex state “equal-

izer,” collections and enforcement all play a role.

BLOCK number

AREA (number sequential township)

SUB-AREA number (section)

* UNIT number for condos and leaseholds

PARCEL number

01—01—301—016—0000

A Word on Property Index Numbers

(PINs)

In Cook County, the Clerk assigns each

property a Property Index Number (PIN), for

both property record and taxation purposes.

PINs are unique 14-digit numbers that

identify each parcel or unit in the county.

When properties are redeveloped, sometimes

they are assigned new PINs. Take the

example of a single-owner building that is

torn down and replaced with a condominium

building. In that case, each separately

owned unit in the building is assigned a PIN.

Conversely, if parcels are combined to build a

new single-owner structure, the multiple PINs

may be consolidated into a single PIN.

8

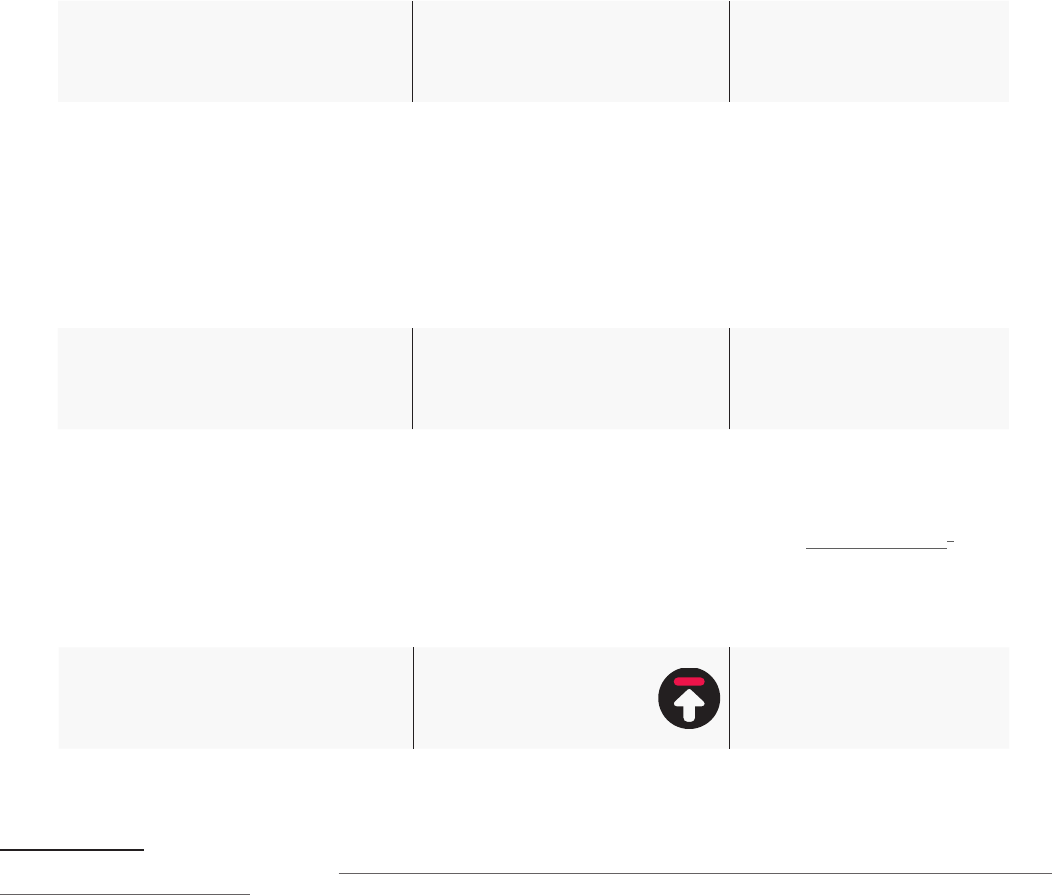

The Cook County Property

Tax Process

Setting property tax amounts to be billed

is a complex, months-long process that in-

volves at least six government agencies.

(See chart on next page.) The decisions

made by these agencies will determine how

much each property owner is billed. The fol-

lowing pages document the entire process,

from setting property values to sending out

the bills and enforcing collection.

Cook County Assessor

• Determines the market value of each

property

• Considers first appeals

• Approves homeowner exemptions

Cook County Board of Review

• Hears property assessment appeals

• Property owners may appeal this

board's decisions to the Illinois Property

Tax Appeals Board or state courts

Illinois Department of Revenue

• Determines an equalization factor to

make property assessments uniform

throughout the state

Local Governments

• Individual taxing districts, municipalities,

schools, fire districts, libraries, etc., set

their levies, which are the amount of

taxes to be collected

Cook County Clerk

• Determines the tax rates, based on the

total levy

• Applies the rates to assessments,

determining taxes owed

Cook County Treasurer

• Prepares and mails tax bills

• Collects from taxpayers

• Distributes collections to taxing districts

• Conducts tax sales

10

How the Illinois Property Tax System Works

Step 1 — Assessments

Assessments are a key and often misunderstood

part of the property tax process. The assess-

ments — estimates of the market value of a

property — determine how much of the overall

property tax burden within a jurisdiction falls on

each individual property owner.

For example, if a property’s assessed value is

one-tenth of 1% of the total assessed value

within a taxing jurisdiction, the owner of that

property is responsible for paying one-tenth of

1% of the burden. So, if the total tax burden in the

local jurisdiction is $1 million, that hypothetical

property owner would pay $1,000.

An increased assessment alone does not predict

a tax increase:

• If a property’s assessment increases at the

same rate as other properties in a taxing dis-

trict — and local governments don’t increase

the amount of money sought in property taxes

(the levy) — the property’s tax bill will hold

steady.

• If a property assessment goes up, but by a

lesser percentage than other properties in the

taxing district — and local governments don’t

increase their property tax levy — the property’s

tax bill will go down.

• If a property’s assessment increases a greater

percentage than other properties in the taxing

district, that property’s bill will go up — even if

local governments don’t increase their property

tax levy.

County and township assessors in Illinois deter-

mine the value of nearly all properties, based on

the “fair cash value,” which is what the property

would sell for on the open market. To determine

those values, assessors look at real estate

market conditions and, in the case of business

and industrial properties, income derived from the

property being assessed. Farm assessments are

based on “agricultural economic value.”

The Illinois Department of Revenue assesses the

values of railroad properties, pollution-control

facilities, low sulfur dioxide emission coal-fueled

devices and regional water treatment facilities

— all of which are assessed by different meth-

odologies than residential and most business

properties.

In all Illinois counties except for Cook County,

the nal assessment level is 33

1

/

3

% of fair cash

value. In Cook, vacant parcels and residential

properties — including apartment buildings — are

assessed at 10% of fair cash value, while busi-

nesses and industries are assessed at 25% of fair

cash value. As a result, a commercial property

with the same market value as a home would

be taxed two-and-a-half times as much as the

home.

Those assessment differentials, designed to

lessen the burden on homeowners and renters,

were a matter of practice long before 1970,

when they were specically allowed in the Illinois

Constitution. As a result, Chicago has one of

the highest effective commercial and industrial

property tax rates among cities across the nation,

according to the Lincoln Institute and the Min-

nesota Center for Fiscal Excellence.

But treating commercial and

residential properties differently

when conducting assessments

is hardly unique to Cook County.

About half of the states have

different tax rates or assess-

ment levels for different types of

property. In nearly all cases, the

different rates in assessment

levels shift more of the burden

from residents to businesses.

And nearly all states, includ-

ing Illinois, have some type of

“homestead” exemption, which

reduces tax bills on primary

residences even further.

It’s worth noting that in recent

years, investigators and ana-

lysts at the Chicago Tribune

and University of Chicago

,,

among others, have determined

that assessments in Cook

County and across the nation

tend to overvalue lower-priced

properties, particularly in Black

neighborhoods, and undervalue

higher-priced homes, typically

in predominantly white neigh-

borhoods. Those analysts

concluded that practice results

in a regressive and inequitable

property tax system that harms

the poor. (Figure 5)

Homeowners and businesses

can apply for various exemp-

tions and reductions that can

lower a tax bill; the assessor

decides whether to grant them.

Figure 5. Chicago Tribune Article from June

10, 2017, Part of a Four-Part Investigation of

Cook County Property Tax Issues

12

How the Illinois Property Tax System Works

General Homestead Exemption

This exemption is available to every homeowner

for their primary residence and is by far the most

common. It lowers a property’s equalized assessed

value by $10,000 in Cook County, $8,000 in adjacent

counties and $6,000 in the rest of the state.

Senior Citizens Homestead Exemption

This exemption is available to homeowners who are

age 65 and older for their primary residence. It results

in an $8,000 reduction in equalized assessed value in

Cook and adjacent counties and $5,000 in the rest of

the state.

Senior Citizens Assessment Freeze Homestead Exemption

Homeowners who are 65 or more years old and have an

annual household income of less than $65,000 may apply

for this exemption. The assessed value of the home is

frozen at the level where it stood when the exemption was

rst received — resulting in lower tax bills as other property

assessments rise.

The three most common homeowner exemptions:

65+

Other potential assessment reductions for various types

of property are included in Appendix I.

C

O

O

K

C

O

U

N

T

Y

B

O

A

R

D

O

F

R

E

V

I

E

W

Step 2 — Appeals

Once assessments are complete, property

owners are notied of the new assessment

values.

Property owners have 30 days to appeal (chal-

lenge) their assessments at their Assessor’s

Oce. In some jurisdictions, an appeal at that

level is informal; in others, there’s a formal written

process. To win an appeal, a homeowner typi-

cally has to prove their property was assessed

at a higher value than comparable properties.

Businesses also can contest their assessments,

using comparisons, occupancy level and income

generation.

If the property owner does not appeal to the

assessor or is dissatised with the assessor’s

appeal decision, the homeowner can le an

appeal with the county Board of Review.

If a property owner is not satised with the Board

of Review’s decision, the property owner has

two options: appealing to the state Property Tax

Appeal Board or to a county Circuit Court. It

often takes years to complete an appeal with the

Appeals Board, and Circuit Court proceedings can

be lengthy in some counties. That means prop-

erty owners generally have to pay the taxes based

on the contested assessment while the appeal is

pending. (Figure 6)

It’s also important to note that studies in the

press and academia have concluded that the

appeals process often makes the property tax

system more regressive, given that wealthier

property owners typically have greater where-

withal to le successful appeals.

Property Tax Assesment Appeal Path

New

Assessment

Board of

Review

Appellate

Court

Illinois

Supreme

Court

US

Supreme

Court

Office of

the

Assessor

Property

Tax Appeal

Board

State Court

Figure 6. Diagram of the property tax appeals

process in Illinois

14

How the Illinois Property Tax System Works

Step 3 — Equalization

The Illinois Department of

Revenue uses the assessed

values of property to calculate

state funding for schools,

highways and public assistance,

with property tax-rich districts

getting less state funding. It

also uses them to determine tax

and borrowing limitations within

taxing jurisdictions, because

those limitations are all based

in part on the assessed values

within each jurisdiction.

Those calculations for state

funding, however, would not

result in fair and equitable distri-

bution of state funds if the state

did not adjust the assessment

results produced by assessors

in the state’s 102 counties.

That’s because Cook County

assesses properties at differ-

ent percentages of fair cash

value than the rest of the state

and some assessors under- or

overvalue properties within their

jurisdictions.

In addition, the state is required

to ensure that the property tax

burden is distributed equally

among property owners

throughout Illinois, which can

only be done if all assessments

reflect the same percentage of

fair cash value.

The Illinois Department of

Revenue “equalizes” assess-

ments across the state so

they are uniform at 33

1

/

3

%

of fair cash value. To do that,

the Department of Revenue

conducts an “assessment/sales

ratio study” that compares a

sampling of assessments to

actual sales, to see if assess-

ments were accurate, while

also accounting for the differ-

ing percentages of assessed

values.

So, in counties outside Cook,

where assessors strive to value

all property for tax purposes at

33

1

/

3

%, it’s only when assessors

miss that mark — determined

by the assessment/sales ratio

study — that adjustments need

to be made.

If assessments in a county

or township do hit that mark,

they are simply multiplied by 1,

meaning they don’t change. But

if they fall short of 33

1

/

3

%, they

will be multiplied by a number

slightly greater than one. For

example, in DuPage County —

Illinois’ second-largest county

— the multiplier for bills sent out

in 2021 was 1.034.

The Equalization for every Illinois county

is set by Illinois Department of Revenue in

Springfeild. Photo: Illinois Ofce of Tourism

If assessments as a whole are above 33

1

/

3

%, they

would be multiplied by a number that’s less than

1 — although that is highly unlikely, given that

under-assessments are far more common than

over-assessments.

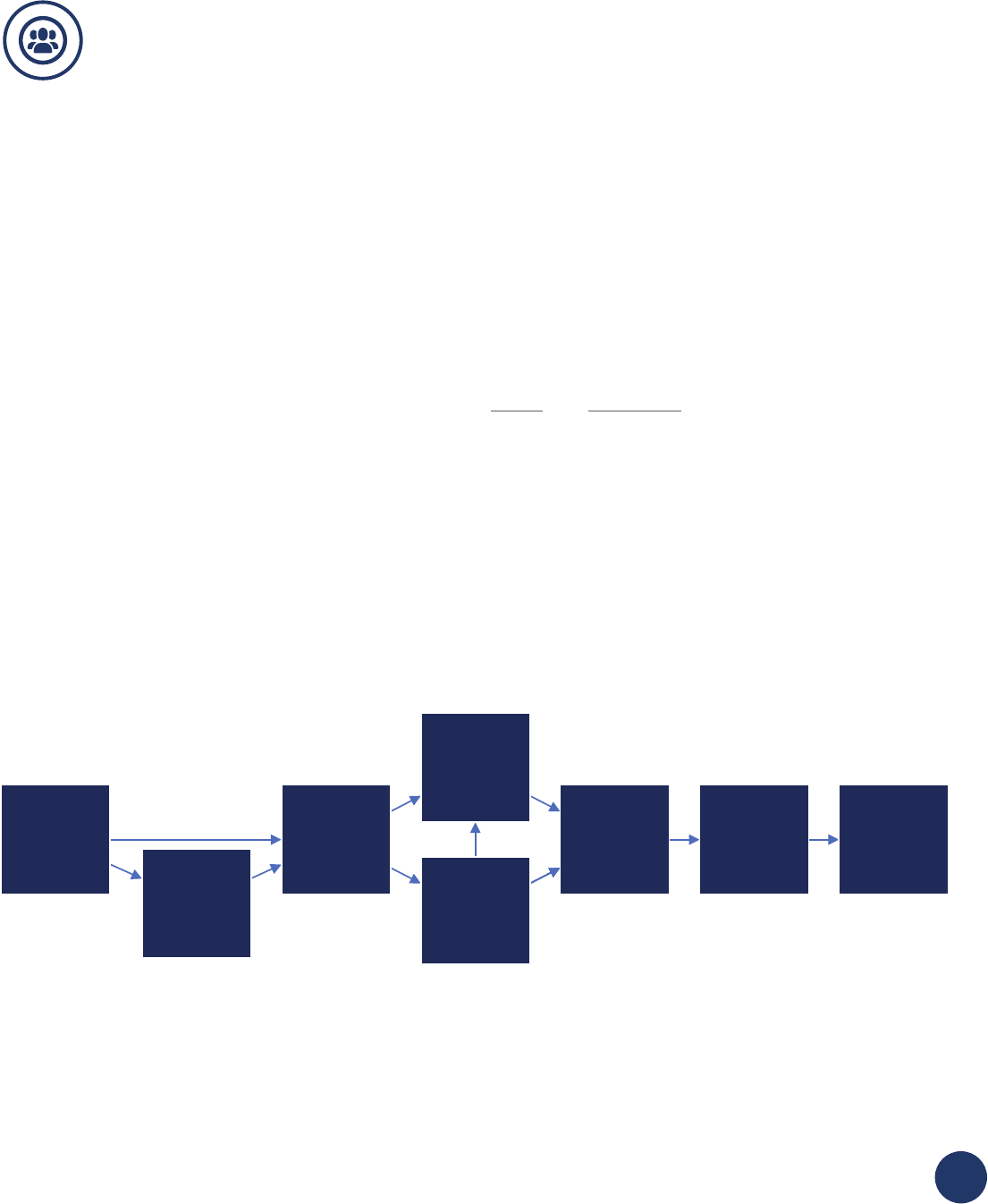

Cook County, however, is much more complicated

when it comes to setting the equalization factor.

Right from the start, the numbers will fall well

below that 33

1

/

3

% because all residential property

is assessed at 10%, and commercial and indus-

trial properties are assessed at 25%. And, histori-

cally, Cook County has tended to undervalue its

properties as a whole.

As a result, bringing the overall assessment level

in Cook up to 33

1

/

3

% requires that they be mul-

tiplied by a number far greater than 1. In recent

decades the multiplier in Cook has been at least

2, and sometimes higher than 3. (Figure 7)

2.5%

2.5%

2.6%

2.7%

2.7%

2.8%

3.0%

3.4%

3.3%

3.0%

2.8%

2.7%

2.7%

2.7%

2.8%

3.0%

2.9%

2.9%

3.2%

3.0%

2.9%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

2002 2006 2010 2014 2018 2022

Multiplier

Tax Year

Cook County Equalization Factors

Figure 7.

16

How the Illinois Property Tax System Works

Step 4 — Setting the Levy

In Illinois, thousands of gov-

ernments — school districts,

municipalities, townships, park

districts, library districts and the

like — each determine annually

the amount they need to collect

from property taxes. Determin-

ing and approving the amount is

known as “setting the levy.”

The amount of the levies set by

local taxing districts determines

whether overall taxes go up or

down. Hypothetically, if every-

one’s assessment increased

by the same percentage in a

given year when the overall

levy increases, taxes will rise

on every property. In reality,

assessments rise by differing

amounts, making the effects

of the overall tax increase vary

from one property owner to

another.

There are state-imposed limits

on how much a taxing jurisdic-

tion can levy, but they tend to

limit increases as opposed to

reducing the overall burden.

The most notable limit comes

from the Illinois Property Tax

Extension Limitation Law,

which restricts tax increases in

non-home rule units of govern-

ment to increases of 5% or the

preceding year’s increase in the

national Consumer Price Index,

whichever is less. The Limita-

tion Law is commonly called the

tax cap.

Although the Limitation Law

applies to all Illinois school dis-

tricts, which account for more

than half the overall property

tax burden, the law does not

apply to home rule municipal

governments — which are given

more independence to make

governing decisions, including

those involving taxation. In Cook

County, 90 of 135 municipalities

have home rule powers.

A municipality is granted home

rule authority when its popula-

tion tops 25,000 or voters in

a referendum agree to make

the municipality a home rule

jurisdiction. Voters also can

remove home rule authority via

referendum.

Once the local governments

vote to approve their budgets

and set their levies, the levy

amounts are sent to the County

Clerk.

Evanston is one of the 90 home rule com-

munites in Cook County. These communities

have more independence to make governing

decisions, including those involving taxation.

Photo Credit

Chicago’s North Shore CVB

Step 5 — Extending the Levy

The County Clerk ensures that the levies submitted by each government don’t exceed the limits under

the tax cap law. The Clerk also applies the equalization factor to the nal assessed values, before the

Assessor applies the exemptions.

Once the exemptions are applied, the Clerk determines the “adjusted equalized assessed value” using

this formula:

Next, the Clerk takes the levies approved by local governments within each of their taxing districts

and divides them by the adjusted equalized assessed value in each of their districts. The result is the

rate, or the number by which each property’s adjusted equalized assessed value must be multiplied to

raise the funds sought by the taxing district:

The Clerk then ensures the rates for each district do not exceed the maximum amounts allowed by

state law for each taxing agency. Once that’s done, the Clerk adds up the rates that apply to each

individual property in the county.

The result is the “aggregate rate,” commonly called the “composite rate.” The aggregate rate is then

multiplied by the assessed value of each property to determine the amount of tax owed:

The Clerk sends the results to the County Treasurer.

(

Assessed

Value

Equalization

Factor

)

-

Exemptions

=

Adjusted

Equalized

Assessed

Value

Levy

=

Tax

Rate

Adjusted Equalized

Assessed Value

Aggregated

Tax Rate

Adjusted Equalized

Assessed Value

=

Total

Tax

18

How the Illinois Property Tax System Works

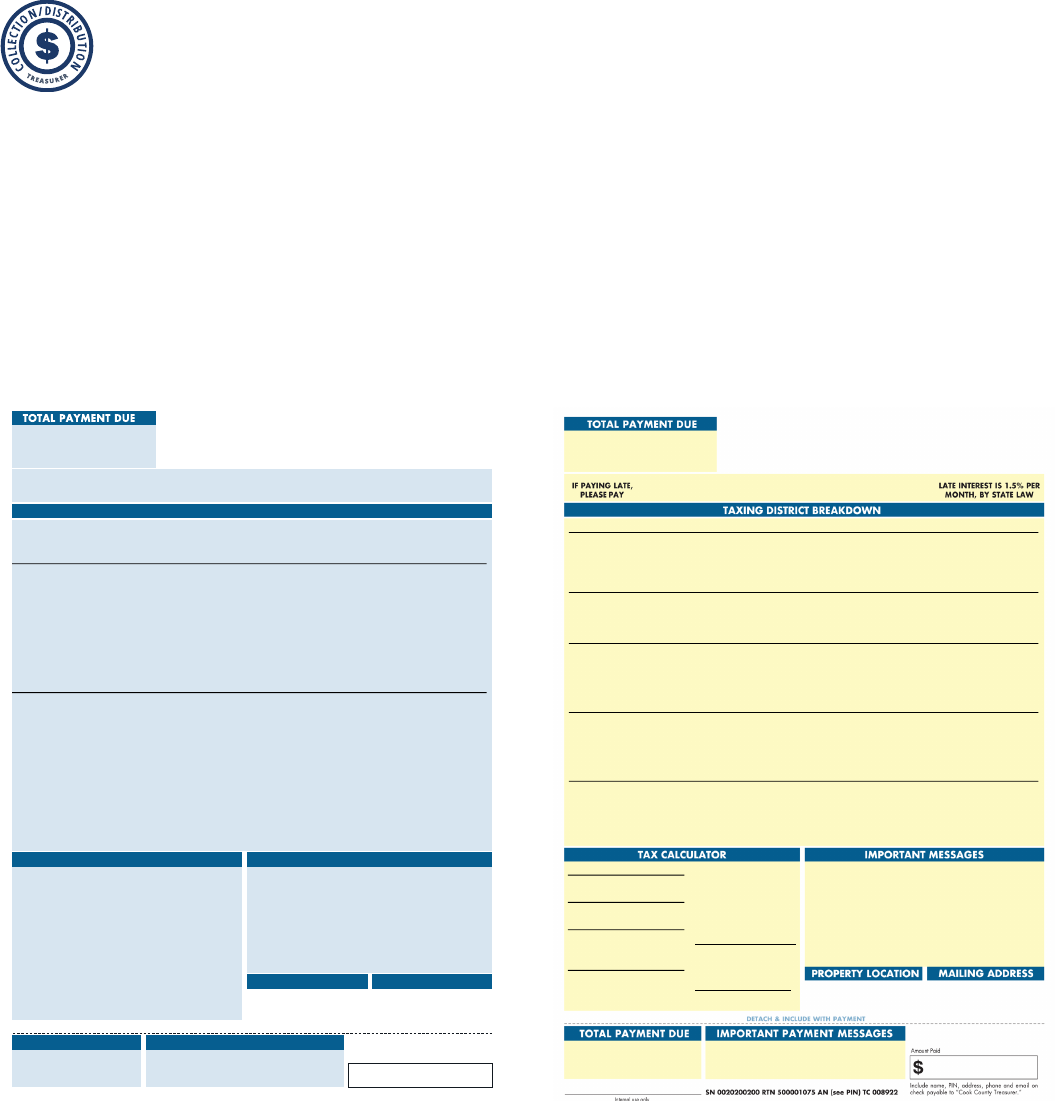

The Treasurer uses the data provided by the Clerk

to prepare the tax bills, which offer a detailed

breakdown of how much each property owner is

being billed by the governments that serve them.

The bills are mailed in two installments. (Figure 8)

$ 5,114.99

By 10/01/23 (on time)

2022 Second Installment Property Tax Bill

ClassificationTownship(Payable In)Tax YearCodeVolumeProperty Index Number (PIN)

2-03LYONS202320222103808018-13-206-015-0000

12/02/23 - 01/01/22OR11/02/23 - 12/01/23OR10/02/23 - 11/01/23

$5,345.15$5,268.43$5,191.71

2021 TaxPension2022 %2022 Rate2022 TaxTaxing District

MISCELLANEOUS TAXES

1.930.09%0.0125.68Des Plaines Valley Mosq Abate Dist Lyons

53.6919.872.83%0.378178.90Metro Water Reclamation Dist of Chicago

81.295.204.00%0.534252.74Summit Public Library District

75.3618.933.67%0.490231.91Summit Park District

212.2710.59%1.414669.23Miscellaneous Taxes Total

SCHOOL TAXES

54.242.63%0.351166.12Moraine Valley College 524 Palos Hills

572.3743.5424.19%3.2261,526.83Argo Community HS District 217 (Summit)

921.15145.3041.45%5.5282,616.35Summit School District 104

1,547.7668.27%9.1054,309.30School Taxes Total

MUNICIPALITY/TOWNSHIP TAXES

313.72346.4416.10%2.1471,016.15Village of Summit

12.840.60%0.08037.86Lyons Mental Health

5.660.27%0.03617.04Road & Bridge Lyons

0.550.02%0.0031.42General Assistance Lyons

8.280.30%0.04018.93Town of Lyons

341.0517.29%2.3061,091.40Municipality/Township Taxes Total

COOK COUNTY TAXES

8.140.940.43%0.05827.45Cook County Forest Preserve District

4.140.00%0.0000.00Consolidated Elections

37.9641.172.06%0.272128.76County of Cook

18.490.99%0.13262.47Cook County Public Safety

6.210.37%0.04923.19Cook County Health Facilities

74.943.85%0.511241.87Cook County Taxes Total

2,176.02100.00%13.3366,311.80(Do not pay these totals)

16,961

2021 Assessed Value

146,830

2022 Property Value

10%

X2022 Assessment Level

14,683

2022 Assessed Value

3.2234

X2022 State Equalizer

2022 Equalized Assessed Value (EAV)

47,329

13.336%

X2022 Local Tax Rate

2022 Total Tax Before Exemptions

6,311.80

2022 Total Tax Before Exemptions

6,311.80

Homeowner's Exemption

.00

Senior Citizen Exemption

.00

Senior Freeze Exemption

.00

2022 Total Tax After Exemptions

6,311.80

First Installment

1,196.81

Second Installment +

5,114.99

Total 2022 Tax (Payable in 2021)

6,311.80

5519 S 72ND CT

SUMMIT IL 60501 2205

CRONCIASF J RBIUAN

3453 S ZELVINA AVE

CHICAGO IL 60638-1430

Property Index Number (PIN)

18-13-206-015-0000

T1LG

Volume

080

$ 5,114.99

By 10/01/23 (on time)

If paying later, refer to amounts above.

Use of this coupon authorizes the Treasurer's Oce to

reduce the check amount to prevent overpayment. Include

only one check and one coupon per envelope.

00202202005181320601500001008922400005191713000052684350000534515200005114995

20-18132060150000-0 20 4 1093135

DDTDFFTTTDTATFTDFTAAADDTTDDFDTTTTTADATDAADDAFDAFFAATTFDDDDTFDTFAA

FRANCISCO J URBINA

OR CURRENT OWNER

5155 S MELVINA AVE

CHICAGO IL 60638-1430

145--41691

COOK COUNTY TREASURER

PO BOX 805436

CHICAGO IL 60680-4155

ADFAFDTATDAFDATFAFTTFATATDTTFDDDDADDFDTADADAFFTAFDFTFATDAFDAFAAFA

18132060150000/0/20/F/0000511499/2

DETACH & INCLUDE WITH PAYMENT

TOTAL PAYMENT DUE

IMPORTANT PAY MENT MESSAGES

MAILI NG ADDRE SS

PROPER TY LOCATI ON

TAX CALCULATOR IMPORTAN T MESSAGES

TAXING DISTRICT DEBT AND FINANCIAL DATA

SN 0020230100 RTN 500001075 AN (see PIN) TC 008911

16-29-204-

Amount Paid

$

Include name, PIN, address, phone and email on check

payable to “Cook County Treasurer.”

Internal use only

IF PAYING AFTER

03/01/24, PLEASE PAY

OR OR

$ 10,984.40

By 03/01/24 (on time)

2023 First Installment Property Tax Bill

ClassificationTownship(Payable In)Tax YearCodeVolumeProperty Index Number (PIN)

3-15CICERO202220231500104516-29-204-

05/02/24 - 06/01/2404/02/24 - 05/01/2403/02/24 - 04/01/24

$11,478.71$11,313.94$11,149.17

% of Pension and

Healthcare Costs

Taxing Districts

Can Pay

Amount of

Pension and

Healthcare

Shortage

Pension and

Healthcare Amounts

Promised by Your

Taxing Districts

Money Owed by

Your Taxing

DistrictsYour Taxing Districts

58.79%$1,219,143,000$2,958,492,000$3,294,323,000Metro Water Reclamation Dist of Chicago

101.68%-$67,512$4,022,629$2,652,196Clyde Park District Cicero

100.00%$0$14,808,702$15,685,457Morton Community College 527 (Cicero)

65.57%$71,138,190$206,593,487$215,607,651J Sterling Morton HS 201 (Berwyn/Cicero)

38.41%$304,237,528$493,940,699$34,866,294Cicero School District 99

30.64%$442,101,126$637,407,413$339,609,093Town of Cicero

39.19%$328,420,280$540,107,634$233,103,051Cook County Forest Preserve District

42.60%$15,481,971,961$26,972,931,181$7,595,772,042County of Cook

$17,846,944,573$31,828,303,745$11,731,618,784Total

PAY YOUR TAXES ONLINE

at cookcountytreasurer.com from your bank account or credit card

19,971.64

2022 TOTAL TAX

55%

X2023 ESTIMATE

10,984.40

=2023 TOTAL TAX

The First Installment amount is 55% of last year's total taxes. All

exemptions, such as homeowner and senior exemptions, will be

reflected on your Second Installment tax bill.

W 22ND PL

CICERO IL 60804

PO BOX

BERWYN IL 60402

Property Index Number (PIN)

T1LG

Volume

045

$ 10,984.40

By 03/01/24 (on time)

If paying later, refer to amounts above.

Use of this coupon authorizes the Treasurer's Oce to

reduce the check amount to prevent overpayment. Include

only one check and one coupon per envelope.

002023010031629204000003008911200010984400000111491700001131394900011478718

20 16-29-204 0 21 0 0405652

FTAAFFFTAATDFFFTTTDATTFTTDFTDATDTFATDAFFFDAAAAADTFTFFTFATADAFDDDA

OR CURRENT OWNER

PO BOX

BERWYN IL 60402

MAIN2--1--1

COOK COUNTY TREASURER

PO BOX 805438

CHICAGO, IL 60680-4116

ADFAFDTATDAFDATFAFTTFATATDTTFDDDDADDFDTADADAFFTAFDFTFATDAFDAFAAFA

162920400000/0/21/E/0001098440/1

First Installment Second Installment

Cook County Property Tax Bills

Step 6 — Collection and Distribution

Figure 8.

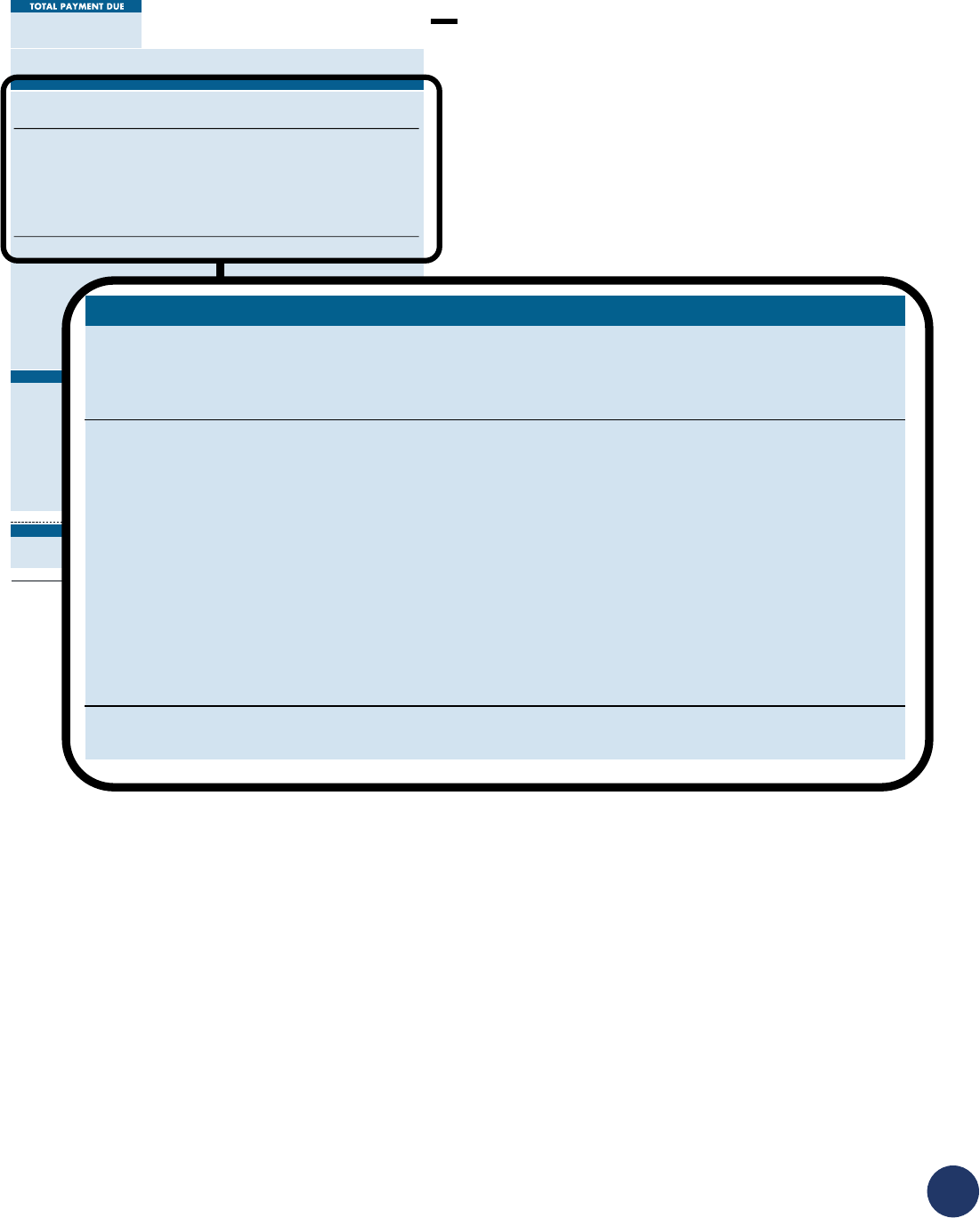

Figure 9. Section of a rst installment Cook County property tax bill

In Cook County, the rst installment is

typically due on March 1. This bill also

includes a breakdown of local govern-

ment debt and unfunded liabilities.

(Figure 9)

DETACH & INCLUDE WITH PAYMENT

TOTAL PAYMENT DUE

IMPORTANT P AY MENT MESSAGES

MAILI NG ADDRE SS

PROPER TY LOCATI ON

TAX CALCULATOR IMPORTAN T MESSAGES

TAXING DISTRICT DEBT AND FINANCIAL DATA

SN 0020230100 RTN 500001075 AN (see PIN) TC 008911

16-29-204-

Amount Paid

$

Include name, PIN, address, phone and email on check

payable to “Cook County Treasurer.”

Internal use only

IF PAYING AFTER

03/01/24, PLEASE PAY

OR OR

$ 10,984.40

By 03/01/24 (on time)

2023 First Installment Property Tax Bill

ClassificationTownship(Payable In)Tax YearCodeVolumeProperty Index Number (PIN)

3-15CICERO202220231500104516-29-204-

05/02/24 - 06/01/2404/02/24 - 05/01/2403/02/24 - 04/01/24

$11,478.71$11,313.94$11,149.17

% of Pension and

Healthcare Costs

Taxing Districts

Can Pay

Amount of

Pension and

Healthcare

Shortage

Pension and

Healthcare Amounts

Promised by Your

Taxing Districts

Money Owed by

Your Taxing

DistrictsYour Taxing Districts

58.79%$1,219,143,000$2,958,492,000$3,294,323,000Metro Water Reclamation Dist of Chicago

101.68%-$67,512$4,022,629$2,652,196Clyde Park District Cicero

100.00%$0$14,808,702$15,685,457Morton Community College 527 (Cicero)

65.57%$71,138,190$206,593,487$215,607,651J Sterling Morton HS 201 (Berwyn/Cicero)

38.41%$304,237,528$493,940,699$34,866,294Cicero School District 99

30.64%$442,101,126$637,407,413$339,609,093Town of Cicero

39.19%$328,420,280$540,107,634$233,103,051Cook County Forest Preserve District

42.60%$15,481,971,961$26,972,931,181$7,595,772,042County of Cook

$17,846,944,573$31,828,303,745$11,731,618,784Total

PAY YOUR TAXES ONLINE

at cookcountytreasurer.com from your bank account or credit card

19,971.64

2022 TOTAL TAX

55%

X2023 ESTIMATE

10,984.40

=2023 TOTAL TAX

The First Installment amount is 55% of last year's total taxes. All

exemptions, such as homeowner and senior exemptions, will be

reflected on your Second Installment tax bill.

W 22ND PL

CICERO IL 60804

PO BOX

BERWYN IL 60402

Property Index Number (PIN)

T1LG

Volume

045

$ 10,984.40

By 03/01/24 (on time)

If paying later, refer to amounts above.

Use of this coupon authorizes the Treasurer's Oce to

reduce the check amount to prevent overpayment. Include

only one check and one coupon per envelope.

002023010031629204000003008911200010984400000111491700001131394900011478718

20 16-29-204 0 21 0 0405652

FTAAFFFTAATDFFFTTTDATTFTTDFTDATDTFATDAFFFDAAAAADTFTFFTFATADAFDDDA

OR CURRENT OWNER

PO BOX

BERWYN IL 60402

MAIN2--1--1

COOK COUNTY TREASURER

PO BOX 805438

CHICAGO, IL 60680-4116

ADFAFDTATDAFDATFAFTTFATATDTTFDDDDADDFDTADADAFFTAFDFTFATDAFDAFAAFA

162920400000/0/21/E/0001098440/1

First Installment Property Tax Bill

Taxing District Debt and Financial Data

Your Taxing Districts

Money Owed by

Your Taxing

Districts

Pension and

Healthcare

Amounts Promised

by Your Taxing

Districts

Amount of

Pension and

Healthcare

Shortage

% of Pension

and Healthcare

Costs Taxing

Districts

Can Pay*

Metro Water Reclamation Dist of Chicago $3,294,323,000 $2,958,492,000 $1,219,143,000 58.79%

Clyde Park District Cicero

$2,652,196 $4,022,629 -$67,512 101.68%

Morton Community College 527 (Cicero)

$15,685,457 $14,808,702 $0 100.00%

J Sterling Morton HS 201 (Berwyn/Cicero)

$215,607,651 $206,593,487 $71,138,190 65.57%

Cicero School District 99

$34,866,294 $493,940,699 $304,237,528 38.41%

Town of Cicero

$339,609,093 $637,407,413 $442,101,126 30.64%

Cook County Forest Preserve District

$233,103,051 $540,107,634 $328,420,280 39.19%

County of Cook

$7,595,772,042 $26,972,931,181 $15,481,971,961 42.60%

Total $11,731,618,784 $31,828,303,745 $17,846,944,573

TAXING DISTRICT DEBT AND FINANCIAL DATA

* Pension and Healthcare liabilities are calculated on a modified accrual basis.

2023 2024

20

How the Illinois Property Tax System Works

$ 5,114.99

By 10/01/23 (on time)

2022 Second Installment Property Tax Bill

ClassificationTownship(Payable In)Tax YearCodeVolumeProperty Index Number (PIN)

2-03LYONS202320222103808018-13-206-015-0000

12/02/23 - 01/01/22OR11/02/23 - 12/01/23OR10/02/23 - 11/01/23

$5,345.15$5,268.43$5,191.71

2021 TaxPension2022 %2022 Rate2022 TaxTaxing District

MISCELLANEOUS TAXES

1.930.09%0.0125.68Des Plaines Valley Mosq Abate Dist Lyons

53.6919.872.83%0.378178.90Metro Water Reclamation Dist of Chicago

81.295.204.00%0.534252.74Summit Public Library District

75.3618.933.67%0.490231.91Summit Park District

212.2710.59%1.414669.23Miscellaneous Taxes Total

SCHOOL TAXES

54.242.63%0.351166.12Moraine Valley College 524 Palos Hills

572.3743.5424.19%3.2261,526.83Argo Community HS District 217 (Summit)

921.15145.3041.45%5.5282,616.35Summit School District 104

1,547.7668.27%9.1054,309.30School Taxes Total

MUNICIPALITY/TOWNSHIP TAXES

313.72346.4416.10%2.1471,016.15Village of Summit

12.840.60%0.08037.86Lyons Mental Health

5.660.27%0.03617.04Road & Bridge Lyons

0.550.02%0.0031.42General Assistance Lyons

8.280.30%0.04018.93Town of Lyons

341.0517.29%2.3061,091.40Municipality/Township Taxes Total

COOK COUNTY TAXES

8.140.940.43%0.05827.45Cook County Forest Preserve District

4.140.00%0.0000.00Consolidated Elections

37.9641.172.06%0.272128.76County of Cook

18.490.99%0.13262.47Cook County Public Safety

6.210.37%0.04923.19Cook County Health Facilities

74.943.85%0.511241.87Cook County Taxes Total

2,176.02100.00%13.3366,311.80(Do not pay these totals)

16,961

2021 Assessed Value

146,830

2022 Property Value

10%

X2022 Assessment Level

14,683

2022 Assessed Value

3.2234

X2022 State Equalizer

2022 Equalized Assessed Value (EAV)

47,329

13.336%

X2022 Local Tax Rate

2022 Total Tax Before Exemptions

6,311.80

2022 Total Tax Before Exemptions

6,311.80

Homeowner's Exemption

.00

Senior Citizen Exemption

.00

Senior Freeze Exemption

.00

2022 Total Tax After Exemptions

6,311.80

First Installment

1,196.81

Second Installment +

5,114.99

Total 2022 Tax (Payable in 2021)

6,311.80

5519 S 72ND CT

SUMMIT IL 60501 2205

CRONCIASF J RBIUAN

3453 S ZELVINA AVE

CHICAGO IL 60638-1430

Property Index Number (PIN)

18-13-206-015-0000

T1LG

Volume

080

$ 5,114.99

By 10/01/23 (on time)

If paying later, refer to amounts above.

Use of this coupon authorizes the Treasurer's Oce to

reduce the check amount to prevent overpayment. Include

only one check and one coupon per envelope.

00202202005181320601500001008922400005191713000052684350000534515200005114995

20-18132060150000-0 20 4 1093135

DDTDFFTTTDTATFTDFTAAADDTTDDFDTTTTTADATDAADDAFDAFFAATTFDDDDTFDTFAA

FRANCISCO J URBINA

OR CURRENT OWNER

5155 S MELVINA AVE

CHICAGO IL 60638-1430

145--41691

COOK COUNTY TREASURER

PO BOX 805436

CHICAGO IL 60680-4155

ADFAFDTATDAFDATFAFTTFATATDTTFDDDDADDFDTADADAFFTAFDFTFATDAFDAFAAFA

18132060150000/0/20/F/0000511499/2

Second Installment

Property Tax Bill

Tax Calculator

Taxing District Breakdown

2021 Assessed Value 16,961 2022 Total Tax Before Exemption

s

Homeowner's Exemption

.00

Senior Citizen Exemption

2023 Assessed Value 14,683 .00

Senior Freeze Exemption

2022 State Equalizer x 3.2234 .00

2022 Equalized Assessed Value (EAV)

47,329

2022 Total Tax Before Exemptions

2022 Local Tax Rate x 13.336% 6,311.81

2022 Total Tax Before Exemptions First Installment 2,296.81

Second Installment +

4,015.00

Total 2022 Tax (Payable in 2023)

6,311.81

$6,311.81

TAX CALCULATOR

6,311.81

2022 Property Value 146,830

2022 Assessment Level

x

10%

Taxing District 2020 Tax 2020 Rate 2020 % Pension 2019 Tax

MISCELLANEOUS TAXES

Des Plaines Valley Mosq Abate Dist Lyons

5.68 0.012 0.09% 1.93

Metro Water Reclamation Dist of Chicago 178.90 0.378 2.83% 19.87 53.69

Summit Public Library District 252.74 0.534 4.00% 5.20 81.29

Summit Park District 231.91 0.490 3.67% 18.93 75.36

Miscellaneous Taxes Total 669.23 1.414 10.59% 212.27

SCHOOL TAXES

Moraine Valley College 524 Palos Hills

166.12 0.351 2.63% 54.24

Argo Community HS District 217 (Summit) 1,526.83 3.226 24.19% 43.54 572.37

Summit School District 104 2,616.35 5.528 41.45% 145.30 921.15

School Taxes Total 4,309.30 9.105 68.27% 1,547.76

MUNICIPALITY/TOWNSHIP TAXES

Village of Summit

1,016.15 2.147 16.10% 346.44 313.72

Lyons Mental Health 37.86 0.080 0.60% 12.84

Road & Bridge Lyons 17.04 0.036 0.27% 5.66

General Assistance Lyons 1.42 0.003 0.02% 0.55

Town of Lyons 18.93 0.040 0.30% 8.28

Municipality/Township Taxes Total 1,091.40 2.306 17.29% 341.05

COOK COUNTY TAXES

Cook County Forest Preserve District

27.45 0.058 0.43% 0.94 8.14

Consolidated Elections 0.00 0.000 0.00% 4.14

County of Cook 128.76 0.272 2.06% 41.17 37.96

Cook County Public Safety 62.47 0.132 0.99% 18.49

Cook County Health Facilities 23.19 0.049 0.37% 6.21

Cook County Taxes Total 241.87 0.511 3.85% 74.94

(Do not pay these totals)

6,311.80 13.336 100% 2,176.02

TAXING DISTRICT BREAKDOWN

Figure 10. Sample of a second installment Cook County property tax bill

Cook County’s second installment is typically

due on Aug. 1. This bill breaks down how much

each agency is taxing the property owner and

how the taxes are calculated. (Figure 10)

Residential Commercial

Schools County City / Village Other taxing agencies

Vacant

Property Owners Pay

The Treasurer Distributes

Money to Taxing Districts

Collection and Distribution

Figure 11. The Treasurer is responsible for the collection and distribution of county funds

Collection and Distribution

Taxpayers who believe their bills are not fair can

dispute their tax bills by ling a complaint in

Circuit Court, but they must pay their taxes in the

meantime. They can challenge the tax rates, the

levy or raise other constitutional questions at this

stage.

The Treasurer records the payments and de-

posits the collected funds into the appropriate

accounts for each taxing district. Outside Cook

County, collected taxes plus any interest earned

on investing the received payments must be

deposited in taxing district accounts within 30

days of the payment due date and every 30 days

thereafter as money continues to come in. In

Cook County, taxes and interest earned are re-

quired to be disbursed starting on June 1 and the

rst day of each month thereafter, but the Cook

County Treasurer distributes funds as they come

in. (Figure 11).

22

How the Illinois Property Tax System Works

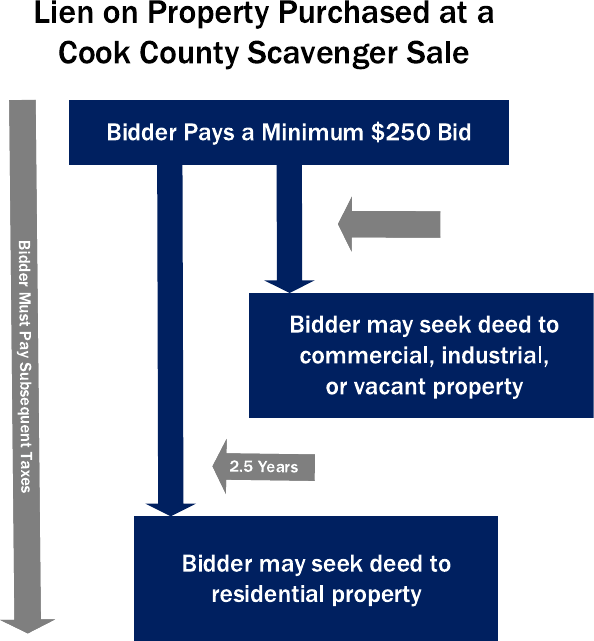

Figure 12. Diagram of the process and penalties accrued when a tax buyer purchases a tax lien

Step 7 — Payment Enforcement

In Cook County, unpaid taxes

accrue interest charges

of 0.75%, or 9% per year, a

reduced rate that went into

effect in March 2024.

9

In the

rest of Illinois, unpaid tax bills

are charged interest of 1.5% a

month, or 18% per year.

Cook County property tax bills

that are not fully paid within 13

months of the second install-

ment due date are offered by

the county Treasurer at the

Annual Tax Sale. (Outside Cook

County, the Annual Tax Sale

takes place four months after

the second installment due

date.)

At the Tax Sale, bidders — often

institutional investors known as

tax buyers — submit the interest

rate they would charge to the

property owner for paying their

delinquent taxes and penalties.

The interest bid cannot exceed

9%. The tax buyer that submits

the lowest interest rate wins.

9 Until March 2024, the monthly interest

rate on late Cook County taxes was 1.5%,

or 18% per year.

That buyer then pays the taxes

and penalties, and a lien is

placed on the property for the

paid amount.

Homeowners and owners of

multi-unit buildings with no

more than six units whose taxes

are “sold” have 2 ½ years to pay

the Clerk the amount paid plus

the interest. This is called “re-

deeming” the taxes. Owners of

commercial and vacant prop-

erty have one year to redeem

their taxes.

Regardless of property classi-

cation, the tax buyer can opt to

extend the redemption period to

a maximum of three years.

The interest rate that the tax

buyer charges is applied every

six months. For example, a 3%

charge would rise to 6% after

six months, 9% after a year and

so on. In the majority of cases,

that increase is meaningless,

Second Installment Tax Due Date

Tax Lien Purchased at Annual Tax Sale

Tax Buyer Pays Next Missed Taxes — 12%

Interest, Owed to Tax Buyer, Added

0 to 9% (as bid by tax

buyer) Interest

Owed

to Tax Buyer

Every 6

Months

0.75 % Simple Interest

Owed Monthly to the

County for 13 Months

(9% Annually)

Tax Liens Purchased by a Tax Buyer

at Annual Tax Sale in Cook County

because tax buyers more often

than not submit 0% interest

bids, guring they’ll make a

prot later in the process.

That prot comes when tax

buyers exercise their right to pay

taxes that go unpaid on proper-

ties after the buyers won them

at the Annual Tax Sale. An im-

mediate 12% interest is applied

to subsequent payments made

by the tax buyer. (Figure 12)

If a property owner fails to

redeem their taxes in time, a tax

buyer can go to Circuit Court

and seek ownership of the

property.

When a property’s taxes are

offered at sale, but not sold,

the taxes are “forfeited” to the

county, which then has the right

to take the property if all taxes

and fees aren’t paid within 2 ½

years. A monthly interest rate

of .75% continues to accrue.

(Figure 13)

If a Cook County property owner

has not paid all or part of their

property tax bills for three years

in a 20-year period, and those

taxes remain delinquent, the

property may go to the biennial

Scavenger Sale — the state’s

last-ditch effort to restore

properties to productive use.

These sales, which were made

optional when the Illinois Prop-

erty Tax Code was amended in

2023, also are conducted by the

Cook County Treasurer.

Figure 13. Diagram of the penalties accrued by forfeited tax lien properties

2 ½ Years

Second Installment Tax Due Date

Forfeited (not sold) at Annual Tax

Sale

0.75 % Simple Interest

Owed Monthly to the

County for 13 Months

(9% Annually)

0.75% Monthly

Interest Continues

County May Take

the Property

Taxes Left Unpurchased at an

Annual Tax Sale in Cook County

A Treasurer’s Ofce study

found that the Scavenger

Sale failed in its mission to

return properties to produc-

tive use

10

, a conclusion also

reached in a subsequent

study by the University of

Chicago

11

.

A detailed follow-up Scav-

enger Sale study

12

by the

Treasurer’s Ofce found

the majority of properties

offered at the Scavenger

10 (The Pappas Studies, 2020)

https://www.cookcountytreasurer.

com/scavengersalestudy.aspx

11 (Schmidt, 2021) https://harris.

uchicago.edu/news-events/news/

comprehensive-independent-analysis-

cook-county

12 (The Pappas Studies, 2022)

https://cookcountytreasurer.com/

pdfs/scavengersalestudy/2022scave

ngersalestudy.pdf

Sale that were located in

areas mapped by the federal

government in 1940 were

redlined, meaning they were

in areas where the federal

government sanctioned the

denial of conventional mort-

gages. That forced minority

homebuyers into predatory

loans that ultimately led to

urban decay and the Black

exodus from Chicago.

13

13 (The Pappas Studies, 2022)

https://cookcountytreasurer.com/

pdfs/scavengersalestudy/2022scave

ngersalestudy.pdf

24

How the Illinois Property Tax System Works

That study recommended

making the Scavenger Sale

optional, as well as cutting in

half interest rates charged on

delinquent Cook County prop-

erty tax payments. The 2023

Property Tax Code amendment

included those changes.

Should Scavenger Sales no

longer be held, the county could

work out payment plans for

owners of occupied, chronically

tax-delinquent properties, while

selecting non-occupied proper-

ties to take after the redemption

period has expired.

In the Scavenger Sale, private

bidders can offer as little as

$250 for a property tax lien,

and governments can get rst

dibs with no-cash bids. Private

buyers must pay all future taxes

on the property to keep open

their option to eventually seek

a court-ordered deed and take

ownership of the property.

As in the Annual Tax Sale, if a

homeowner doesn’t redeem

within 2 ½ years after their taxes

are sold at the Scavenger Sale,

the buyer can go to deed on the

property. On business, industrial

and vacant properties, buyers

can go to deed after one year.

(Figure 14)

Some buyers, however, back out

of taking an unwanted property

by going to court and seeking

what’s called a sale in error.

Those sales in error are sought

primarily in Annual Sales, where

buyers typically look to make a

prot, not acquire property

A Treasurer’s Ofce study found

that tax buyers — mostly hedge

funds and private equity rms —

use the esoteric sales-in-error

process to back out of deals

in ways not allowed in other

states.

Under sales in error, tax buyers

received refunds of about

$277.6 million, including at least

$27.7 million in interest, during

a seven-year period ending in

September 2022. Of that, 87%

was refunded by local govern-

Figure 14. Diagram of the “Go to Deed” process following a scavenger sale

1 Year

2022 Scavenger Property Sale at Navy Pier

The Cycle Starts Over

Once the bills have gone out and the

vast majority of property owners have

paid, the cycle starts over, with asses-

sors outside Cook County revaluing all

properties again. In Cook County, where

a third of the county is assessed each

year, the Assessor moves on to the next

area.

T

R

E

A

S

U

R

E

R

C

O

L

L

E

C

T

I

O

N

/

D

I

S

T

R

I

B

U

T

I

O

N

T

R

E

A

S

U

R

E

R

P

A

Y

M

E

N

T

E

N

F

O

R

C

E

M

E

N

T

C

O

U

N

T

Y

C

L

E

R

K

E

X

T

E

N

D

T

H

E

L

E

V

Y

B

O

A

R

D

O

F

R

E

V

I

E

W

A

P

P

E

A

L

S

/

R

E

V

I

E

W

S

T

A

T

E

E

Q

U

A

L

I

Z

A

T

I

O

N

D

E

P

A

R

T

M

E

N

T

O

F

R

E

V

E

N

U

E

T

A

X

I

N

G

D

I

S

T

R

I

C

T

S

S

E

T

T

I

N

G

T

H

E

L

E

V

Y

A

S

S

E

S

S

O

R

A

S

S

E

S

S

M

E

N

T

ments serving predominantly

Black and Latino residents

— making it even tougher

for many scally challenged

communities to deliver basic

services.

The Treasurer’s Office

recommended

14

closing

numerous loopholes to reduce

sales in error. Many of those

loopholes were closed with the

passage of the 2023 Property

Tax Code amendments.

14 (The Pappas Studies, 2023) https://

www.cookcountytreasurer.com/siestudy-

links.aspx

Photo Credit

Cook County Treasurer’s Ofce

26

How the Illinois Property Tax System Works

Appendix

Additional Exemptions & Forms of Tax Relief

Long-time Occupant Homestead Exemption

(Cook County only) – This exemption is avail-

able to homeowners with a household income

of $100,000 or less who have lived in the home

for 10 continuous years, or ve years if the

homeowner received government or nonprot

assistance to purchase the home. When this

is granted, annual increases in assessed value

are limited to 7% for households with income

of $75,000 or less and 10% for households

with income higher than $75,000 but less than

$100,000.

Standard Homestead Exemption for Veterans with

Disabilities – This exemption reduces assessed

values for veterans based on the percentage level

of their service-related disability. For homeown-

ers who are at least 70% disabled, the property is

exempt from taxation up to $250,000 of equalized

assessed value. Exemptions are $5,000 of equal-

ized assessed value for people at 50% to 69%

disability, and exemptions of $2,500 are available

to veterans with 30% to 49% disability.

Returning Veterans Homestead Exemption – This

exemption is available to U.S. military veterans

who recently returned from active duty in armed

conflict involving U.S. armed forces. The exemp-

tion applies to the primary residence owned by

the veteran. It reduces equalized assessed value

by $5,000 and lasts for two years.

Veterans with Disabilities Exemption for Specially

Adapted Housing – This exemption is available to

disabled veterans who received federal or non-

prot funding to specially adapt housing to their

needs. This potential exemption can reduce a

property’s assessed value by up to $100,000.

Homestead Exemption for Persons with Dis-

abilities – This exemption allows disabled people

paying property taxes to receive a $2,000 reduc-

tion in their equalized assessed value.

Homestead Improvement Exemption – This ex-

emption is available to homeowners who make

improvements, like adding a room or remodeling

that increases the value of the home. It’s also

available to homeowners who rebuild their home

after a catastrophic event. This exemption is

limited to value added by the improvements,

with a maximum exemption of $75,000 of fair

cash value, which translates into a reduction in

assessed value of $7,500. The exemption expires

after four years.

Natural Disaster Homestead Exemption – This

exemption is for homeowners whose homes had

to be rebuilt after a natural disaster. The amount

of the exemption is equal to the current value of

the rebuilt home minus the value of the home

before it was damaged. The exemption continues

until the property is sold or transferred.

Historic Residence Property Tax Assessment

Freeze – This exemption is available to owners

of homes that are certied as historic residences

when the owner rehabilitates the home. This

exemption freezes the assessment at the level

where it stood before rehabilitation for eight

years, then ramps it up to actual fair cash value

over the next four years.

Full Exemptions for Religious, Charitable or

Educational Organizations – This tax break elimi-

nates taxes on non-prot, religious and educa-

tional properties with the approval of the county

Board of Review and the Illinois Department of

Revenue.

Business Incentive Tax Reductions – The state

of Illinois and many Illinois counties offer various

incentives for businesses that relocate or expand

in their jurisdictions. Typically, these tax breaks

lower the assessment levels for business and

industrial properties below the statutorily required

25% for several years.

Senior Citizens Real Estate Tax Deferral Program

– This allows homeowners who are at least 65

years old and make no more than $65,000 a year

to defer up to $7,500 in tax payments each year.

The state pays the amount deferred and places

a lien on the property. When the home is sold or

transferred, the state collects the money plus 3%

annual interest.

28

How the Illinois Property Tax System Works

Ofces Involved in

Property Taxation

C

O

O

K

C

O

U

N

T

Y

C

L

E

R

K

R

E

C

O

R

D

I

N

G

S

Cook County Clerk, Recorder of Deeds Division

• The Clerk assigns a PIN to each property.

• Then the Recorder of Deeds, which in Cook County is a division of the Cook County Clerk’s

Ofce, records and maintains property records.

• Records include property transfers, deeds, mortgages and liens, all of which must be led with

the Clerk.

Cook County Assessor

• The Assessor estimates the market value of each property in his or her jurisdiction for taxation

purposes.

• The Assessor also grants various property tax exemptions.

C

O

O

K

C

O

U

N

T

Y

B

O

A

R

D

O

F

R

E

V

I

E

W

Cook County Board of Review

• In Cook County, three commissioners are elected to the Board of Review, which considers

appeals of assessments made by the Assessor’s Ofce.

Illinois Property Tax Appeal Board

• This panel, appointed by the governor, considers appeals led by property owners who are

dissatised with their appeals to the Board of Review.

D

E

P

A

R

T

M

E

N

T

O

F

R

E

V

E

N

U

E

I

L

L

I

N

O

I

S

Illinois Department of Revenue

• The Illinois Department of Revenue assesses certain special properties.

• It also works to ensure that the tax burden is distributed fairly throughout the state.

C

O

O

K

C

O

U

N

T

Y

T

A

X

I

N

G

D

I

S

T

R

I

C

T

S

Local Governments (Taxing Districts)

• Each local taxing districts — including schools, municipalities, counties, park districts, library

districts and other agencies that deliver specialized services — determine the overall amount of

property taxes (the levy) to be sought from property owners.

• The districts cannot exceed limits set by the Illinois legislature.

Cook County Clerk, Property Tax Division

• The County Clerk determines the tax rates, based on assessment levels and levies sought, that

will be applied to each property.

C

O

O

K

C

O

U

N

T

Y

T

R

E

A

S

U

R

E

R

'

S

O

F

F

I

C

E

Cook County Treasurer

• The Treasurer’s Ofce prepares the property tax bills, collects payments and distributes the

money collected to the appropriate local governments.

• The Treasurer also conducts tax lien sales on tax-delinquent properties.

• The Treasurer also issues all property tax refunds.

Additional Sources

“Compounding Debt: Race, Affordability, and

NYC’s Tax Lien Sale,” from the Coalition for Af-

fordable Homes in New York City <https://cnycn.

org/report-compounding-debt-tax-lien/>

“The Tax Divide,” a Chicago Tribune series on

how assessments in Cook County tend to favor

the wealthy at the expense of the less affluent:

<https://www.chicagotribune.com/investiga-

tions/ct-tax-divide-investigation-20180425-sto-

rygallery.html>

“Reassessing the Property Tax” by Christopher

Berry, professor at The University of Chicago

Harris School of Public Policy. This study ques-

tions whether mass-appraisal systems can ever

be fair: <https://cpb-us-w2.wpmucdn.com/

voices.uchicago.edu /dist/6/2330/les/2019/04/

Berry-Reassessing-the-Property-Tax-3121.pdf>

“Racial Disparities and Cook County Tax Sale

Evictions,” a study from Housing Action Il-

linois that shows tax delinquency evictions

disproportionately affected Black communities:

<https://housingactionil.org/downloads/Policy/

Racial-Disparities-and-Cook-County-Tax-Sale-

Evictions.pdf>

“Unconscionable: Tax Delinquency Sales as a

Form of Dignity Taking,” by University of Virginia

Professor Andrew Kahrl: <https://scholarship.

kentlaw.iit.edu /cklawreview/vol92/iss3/11/>

“The Assessment Gap: Racial Inequalities in

Property Taxation,” by Carlos Avenancio-León,

Indiana University, and Troup Howard, University

of California, Berkeley: < https://equitablegrowth.

org/working-papers/the-assessment-gap-racial-

inequalities-in-property-taxation/>

“Estimating Property Tax Shifting Due to Regres-

sive Assessments,” by Professor Christopher

Berry of the University of Chicago Harris School

of Public Policy. < https://cpb-us-w2.wpmucdn.

com/voices.uchicago.edu/dist/6/2330/

les/2020/02/Tax-Shifting-Due-to-Regressive-

Assessments.pdf >

“How Lower-Income Americans Get Cheated

on Property Taxes,” New York Times. < https://

www.nytimes.com/2021/04/03/opinion/sunday/

property-taxes-housing-assessment-inequality.

html >

30

How the Illinois Property Tax System Works

References

Berry, C. (2021). Reassessing the Property Tax.

Berry, C., Atuahene, B., Black, D., Fowler, A., Fouir-

naies, A., Gottleib, J., . . . Wang, X. (2021,

3). Reassessing the Property Tax. Chicago.

Retrieved from www.census.gov/data/

datasets/2016/econ/local/public-use-

datasets.html

Brown, P., & Hepworth, M. (2002). A Study of

European Land Tax Systems Second Year

Report Lincoln Institute of Land Policy

Working Paper.

Carlos, A.-L., Troup, H., Avenancio-León, C.,

Howard, T., Aneja, A., Cicala, S., . . .

Zucman, G. (2000). Working paper series

The Assessment Gap: Racial Inequalities

in Property Taxation https://equitable-

growth.org/working-papers/the-assess-

ment-gap-racial-inequalities-in-property-

taxation/ The Assessment Gap: Racial

Inequalities in Property Taxation. Retrieved

from https://equitablegrowth.org/

working-papers/the-assessment-gap-

Coalition for Affordable Homes. (n.d.). Com-

pounding Debt Race, Affordability, and

NYC’s Tax Lien Sale.

Housing Action Illinois. (2010). RACIAL DIS-

PARITIES AND COOK COUNTY TAX SALE

EVICTIONS.

Retrieved from https://www.nytimes.