How Champaign County

Property Tax Works

By Champaign County Clerk Aaron Ammons

What are

Property

Taxes?

According to the Illinois Department of Revenue: Property

tax is a tax that is based on a property’s value (ad

valorem). Property is defined as “real property,” land and

any permanent improvements.

Property tax is the largest single tax in Illinois and is a

major source of revenue for local government. Property

tax is the main source of funding for schools, parks,

libraries, fire & police services, and other local

government operations.

Illinois does not have a state property tax. The last year

the State of Illinois had a property tax was 1932. Since

then, property taxes have only been utilized by local

government.

Each Township

Assessor assesses property

values within their Township. With

the exception of farmland & farm

buildings, property is assessed at 1/3

of fair market value. Farmland

Assessments are based on

productivity index provided by the

State of Illinois & soil types. Farm

buildings are assessed at 1/3 of the

contributory value to the farm.

The County Assessment Office

reviews the work of the Township

Assessors and may equalize

assessments as appropriate to ensure

that property is assessed at 1/3 of

fair market value. The Board of

Review hears complaints and

adjusts, as necessary.

After the County Assessment

Office and Board of Review finish

their work an abstract of property

values is submitted to the Illinois

Department of Revenue, who issue

a final multiplier to ensure

property valuations are at 1/3 of

fair market value.

Meanwhile, the Boards of units of local

government are meeting to adopt their

budgets and to determine how much

revenue to request from property taxes,

which is referred to as a "Tax Levy."

Budget and Tax Levy Ordinances are

filed with the County Clerk

The County Clerk calculates property tax rates by

dividing each local government's tax levy by the

equalized assessed value of property within their

boundaries. At this step, tax caps are applied to

limit affected districts to a year-to-year increase

equivalent to the rate of inflation.

The tax rate for your property is the cumulative

property tax rate of all the units local government

in which your property lies.

The County Clerk also adds to certain property tax

bills any Court approved assessments for

maintenance of drainage ditches within the

County.

The County Treasurer and Collector

sends out the property tax bills,

collects property tax revenue, and

distributes it to the units of local

government. The Office also sells any

unpaid taxes at the annual tax sale.

What is the Property Tax Cycle?

How are

Property Tax

Rates

Determined?

Property values are assessed and equalized at 1/3 of fair market

value, and any exemptions or abatements are subtracted to create a

taxing value for each property.

The County Clerk calculates the property tax rate for each unit of

local government by dividing their tax levy by the taxing value of all

of the property within their boundaries. At this step, fund rate limits

are implemented, and tax caps are applied, which limit affected

districts to a year-to-year increase equivalent to the rate of

inflation.

The tax rate for your property is the cumulative property tax rate of

all the units of local government in which your property lies.

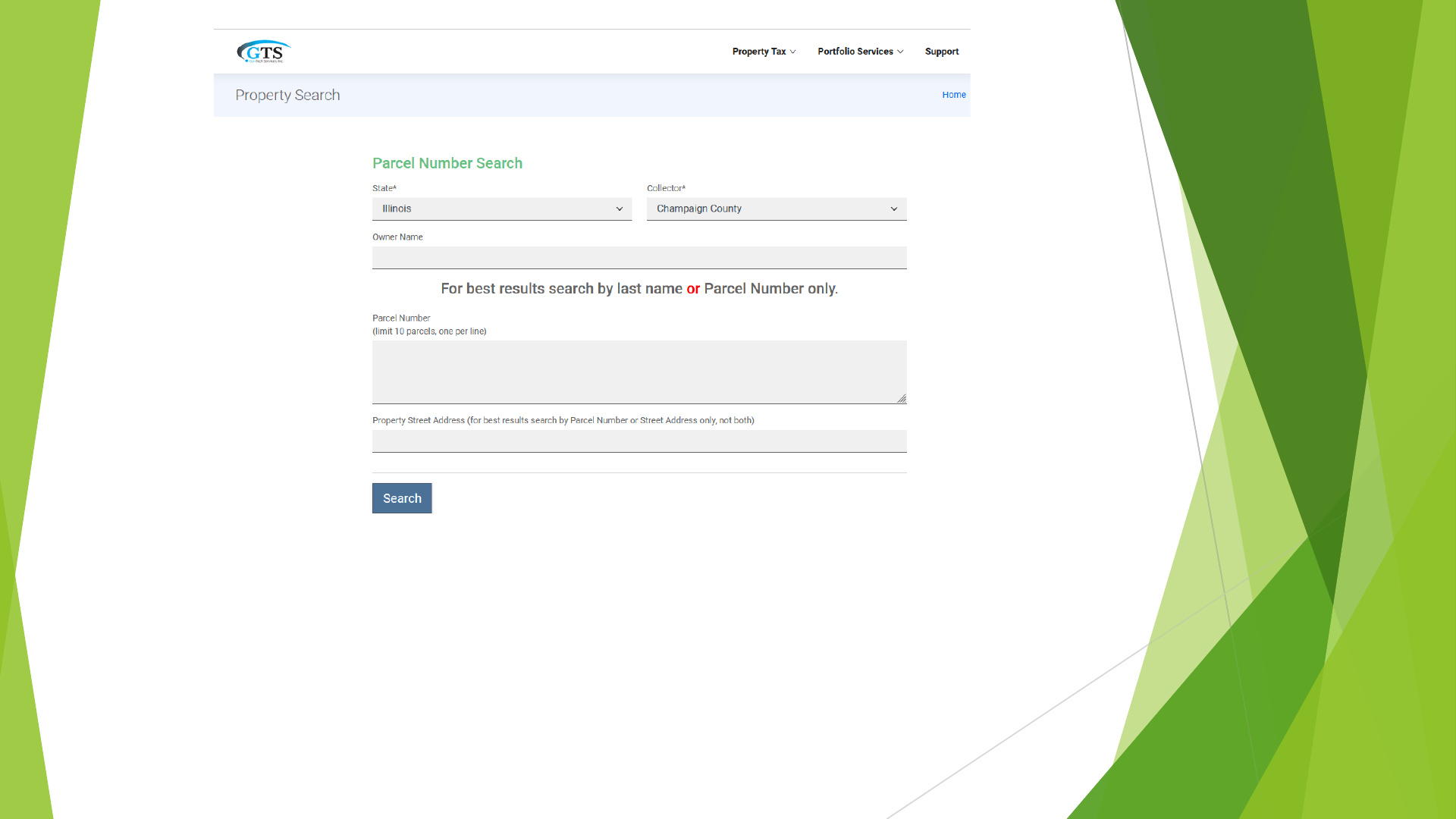

Pay Your Property Tax or Mobile Home Bill Online

The link can be found at http://www.co.champaign.il.us/treasurer

What Happens If You Cannot Pay Your

Mobile Home or Property Taxes

If you do not pay your mobile home or property taxes by the delinquency date, the County Treasurer

is required by law to seek court judgement against those owners with delinquent taxes and to sell

those taxes at the Annual Tax Sale.

At the tax sale, investors (tax buyers) will bid their "service" fee for paying the delinquent taxes,

with the lowest bid winning. This fee is a percent of the taxes sold and will be added to the balance

at the tax sale and every six months thereafter. Bids range from a maximum of 18% every six months

to 0%.

Interest begins accruing on the date of the tax sale, in the amount bid by the tax buyer. Every six

months more interest is added. As time progresses, the tax buyer will add costs for notifications,

publications, court filings and service fees. If subsequent years taxes are also unpaid the tax buyer

can pay those once they become delinquent and add them to the original amount, with a 12%

annual interest penalty. The original tax amount, plus any subsequently purchased taxes along with

all interest and fees must be paid at once to "redeem" the property from the tax sale.

What Happens If You Cannot Pay Your

Mobile Home or Property Taxes

The mobile home or property owner or other financially vested party has a period of

time to pay (redeem) the taxes following the tax sale before they could lose ownership.

For residential properties of 1 to 6 units, the minimum redemption period is 2 1/2

years. For all other properties (commercial, vacant, etc.) the minimum redemption

period is 2 years. At the tax buyer's discretion, the redemption date can be extended up

to a maximum of 3 years.

If the taxes are not redeemed by the end of the final redemption period the Court may

order the issuance of a tax deed, which passes title for the mobile home or property to

the tax buyer.

If you think you have delinquent property taxes, check your property at

https://champaignil.devnetwedge.com/ and you can find info on how to pay the

delinquent tax at

https://champaigncountyclerkil.gov/property-taxes/delinquent-

property-tax-search The longer you wait, the more expensive it can get.

Contact Your

Local Tax

Offices

If you have further questions, don’t

hesitate to reach out to your local tax

offices.

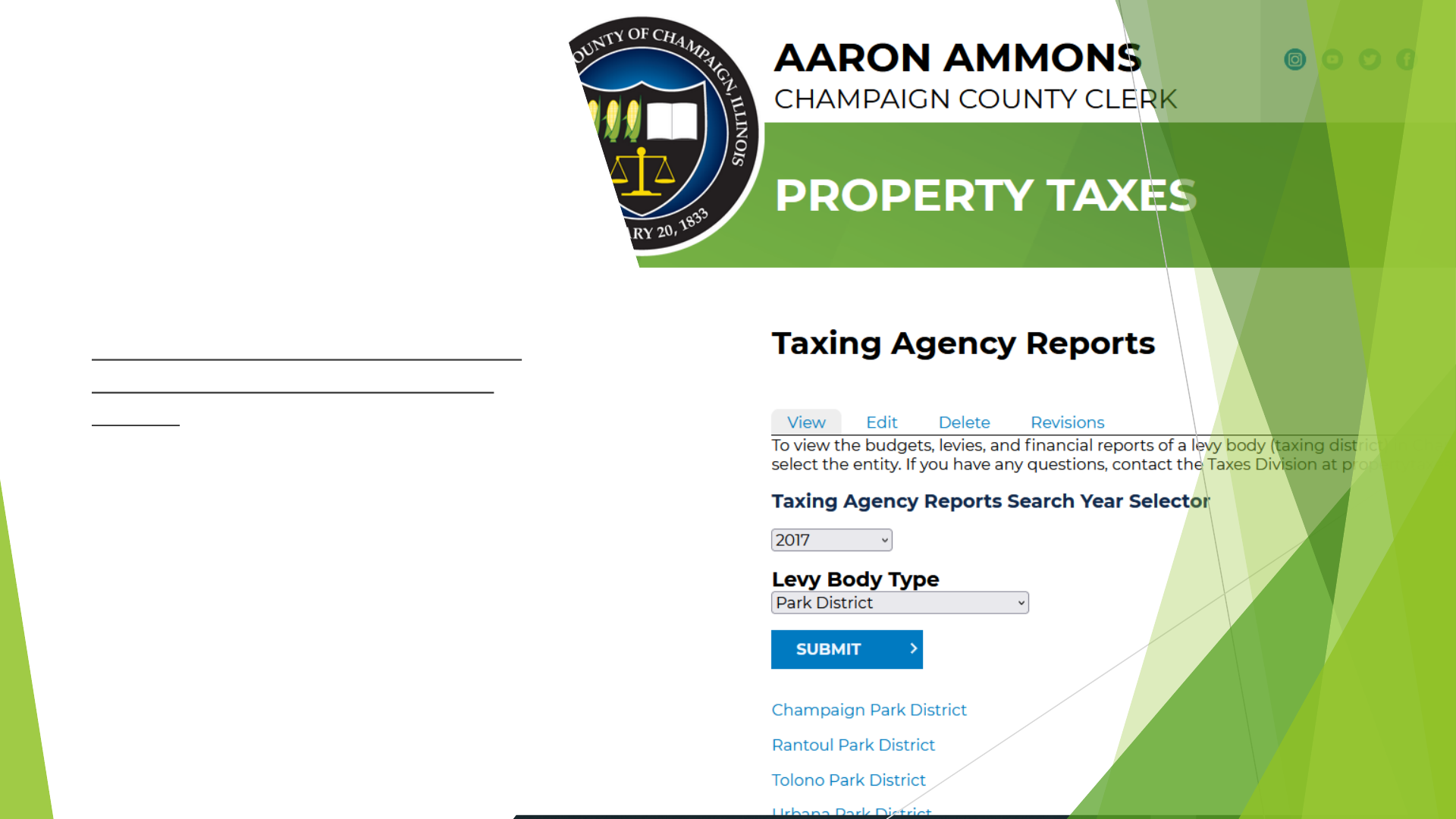

Champaign

County Clerk

The Clerk’s Office maintains Tax Sale, Judgement and Forfeiture

records and performs tax rate and tax cap calculations required

for the property tax cycle (tax extension).

The Clerk’s Office is also responsible for accepting

property annexations or detachments and financial documents

from local governments required for tax extension.

The Clerk's Office maintains the register of mobile home

ownership.

Find more info at https://champaigncountyclerkil.gov/property-

taxes

Champaign

County

Treasurer

The Collector sends out approximately 77,000 real estate tax bills annually and

collects funds that are distributed to 125 taxing districts. The bills are usually

mailed in early May and are typically due in June and September each year. The

annual tax sale occurs in late October for properties with unpaid tax bills.

The Collector also sends out 3,400 Mobile Home tax bills. The bills are mailed in

March and are due sixty days after mailing.

The County Treasurer is, by law, the Treasurer and Collector for all drainage

districts, unless they appoint someone else to one or both positions. The County

Treasurer is currently Treasurer for 57 drainage districts in Champaign County.

County Treasurers are more cash managers than long-term investors. Our

investment objectives are Safety, Liquidity, and Yield in that order. These

objectives are spelled out in our Investment Policy, required by Illinois law for

custodians of public funds

Find more information at

https://www.co.champaign.il.us/treasurer/treasurer.php

Champaign

County

Assessor

The Assessment Office plays an important role in your local government. The

office is responsible for over 76,000 parcels. Our mission is to provide the

public with top quality service by helping the public access information and

understand the property assessment process.

The County Assessment Office strives to administer an accurate, fair, uniform,

and timely assessment of all real property in Champaign County in accordance

with, and as mandated by, the Illinois Property Tax Code.

Other duties of the office include name and address changes for property tax

bills, assists taxpayers with all property tax exemptions, equalizes assessments,

performs sales ratio studies, mails assessment changes notices, publishes

assessment changes in newspapers and prepares the tentative and final

abstracts.

Find more information on the Assessor’s website -

https://www.co.champaign.il.us/ccao/assessor.php

Champaign

County Board

of Review

The Board of Review reviews property tax assessments in the County.

The Board of Review accepts and holds hearings on assessment complaints

from July 1 to September 10. After September 10, members research

values on each complaint filed, thereafter issuing a written decision.

Other duties of the Board of Review include the following: intra-County

equalization of property values, representing the County in all State of

Illinois Property Tax Appeal Board proceedings, adding omitted properties

to the assessment records, and acts on exemption requests.

Find more info abut the Board of Review at

https://www.co.champaign.il.us/boardofreview/boardofreview.php